Are CEO successors more likely to implement environmentally responsible behavior? Empirical evidence from listed companies in China

Introduction

From the 18th National Congress report, which emphasized the need to “establish an ecological civilization concept that respects, adapts to, and protects nature,” to the 19th National Congress report, which called for “accelerating the reform of the ecological civilization system, building a beautiful China, and recognizing that green mountains and clear waters are as valuable as mountains of gold and silver,” top-level policy initiatives have underscored the importance and urgency of environmental protection (Ding and Shahzad, 2022; Feng et al., 2021). From the perspective of overall economic development, China has entered a new phase characterized by slower growth, a transition from quantity to quality, and structural optimization. Against the backdrop of “coordination between environmental protection and socio-economic development,” stakeholders across society have raised higher demands for enterprises to correctly establish environmental concepts and actively fulfill their environmental responsibilities (Zou et al., 2019). For micro-level enterprises, how to respond to national initiatives by integrating environmental responsibility into their development strategies, shifting from passive compliance to active pursuit, and creating a value-sharing business model, is not only a critical issue for corporate strategic planning and decision-making but also an important topic of widespread attention in both academic and practical fields (Xu et al., 2021).

Environmental responsibility requires companies not only to maximize profits but also to minimize their negative impact on the ecological environment. In other words, economic development should not come at the expense of the environment. Instead, companies should take concrete actions to reduce carbon emissions and waste pollution in their operations, while improving resource utilization efficiency (Lin and Zhang, 2023). Current academic research on corporate environmental responsibility (CER) mainly falls into two categories. On one hand, studies focus on the antecedents of corporate environmental responsibility, exploring the market competition pressures and institutional environments that drive businesses to fulfill their environmental duties. For example, Yang et al. (2017) argue that when a company’s environmental performance differs from that of its peers, it faces legitimacy pressure from the public and stakeholders, which prompts an improvement in its environmental responsibility. Flammer (2015) suggests that under intense market competition, firms are inclined to fulfill environmental responsibilities to distinguish themselves from competitors and mitigate threats from external rivals. Kang et al. (2010) argue that firms may fulfill environmental responsibilities to avoid government-imposed sanctions related to potential operational and environmental damages. On the other hand, research also examines the effects of corporate environmental responsibility and its value-creating mechanisms. For instance, Luo and Du (2015) take a knowledge acquisition perspective and suggest that fulfilling environmental responsibilities enables firms to gain technological innovation resources from stakeholders, thereby promoting innovation investments. Duanmu et al. (2018) found that fulfilling environmental responsibilities helps companies attract government attention and recognition, leading to rewards and support such as tax benefits, bank loans, and project approvals. Nelwan (2016) discovered that fulfilling environmental responsibilities helps build a positive environmental image in the public’s perception, gaining more support from stakeholders and, thus, enhancing competitive advantages.

Existing literature in this field shows that with increasing attention to the ecological environment and low-carbon economy, academic research on corporate environmental responsibility has been gradually increasing, yielding a series of significant findings. However, it is important to note that the analysis of corporate environmental responsibility motivations has largely focused on the characteristics at the firm level, while there has been less emphasis on the decision-making tendencies following CEO turnover, which is the core driver of corporate environmental strategy (Mooney et al., 2013). Although some literature has recognized the connection between managerial characteristics and corporate environmental decision-making, the current research still primarily adopts a static perspective on executive characteristics, overlooking the dynamic influences, particularly regarding career stability, which is a key concern for management (Aghamolla and Hashimoto, 2021; Meng et al., 2024; Sun and Jiang, 2022). As competition in Chinese markets and industries intensifies, the tenure of CEOs is becoming shorter, and turnover rates are rising (Liu, 2020). As a strategic decision-making tool, CEO succession is gradually becoming an effective means for companies to cope with performance pressure, capture momentum for transformation, and enhance market competitiveness (Su et al., 2022; Zhang et al., 2021).

As the main participants and executors of corporate decision-making, CEO succession not only causes significant internal disruption within the company, determining future resource allocation and strategic positioning but also provides an opportunity for the company to realign with environmental goals (Bae and Joo, 2021). CEO succession grants the new CEO greater discretion and decision-making power over the company’s future green strategies and environmental decisions (Xu et al., 2022; Tran and Adomako, 2021). However, the attitude of a successor CEO toward CER remains unclear. Consequently, CEO succession offers an intriguing dynamic perspective for studying environmental responsibility at the micro level. What is the successor CEO’s attitude toward environmental issues? Will this influence the company’s environmental strategy and responsibility fulfillment? Does the successor CEO’s attitude toward environmental responsibility vary due to the influence of other factors? Previous literature has not explored these questions. Therefore, given the practical importance of these issues for enterprises and the current gap in theoretical literature, we aim to explore and analyze these questions in the following study.

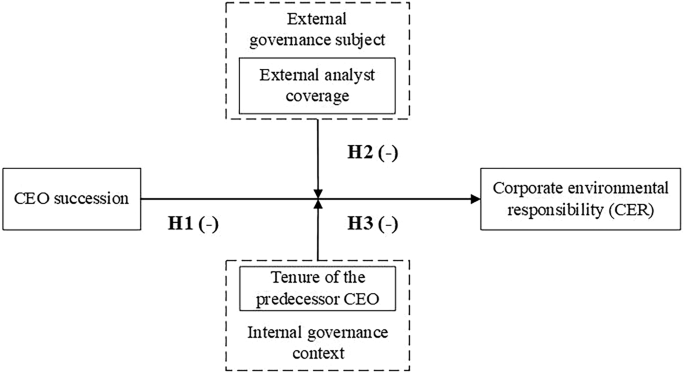

This study uses impression management theory and the “quick win” hypothesis to explain the relationship between CEO succession and CER in the Chinese context, while also exploring the contingency of this relationship. Specifically, we collect data from Chinese A-share listed companies from 2010 to 2023 and employ OLS panel regression to empirically test the relationship between CEO succession and CER. Based on both internal and external governance contexts, we select analyst coverage as an external variable to investigate the oversight of successor CEO decision-making motives and the tenure of predecessor CEOs as an internal moderator variable to explore the boundaries of the successor CEO’s impact on environmental responsibility. The results indicate that under the threat of board departure, successor CEOs may engage in impression management to appease the board by delaying the implementation of environmental responsibility—a strategic decision that requires long-term investment. Moreover, external analyst coverage and the tenure of predecessor CEOs further amplify the negative effect of CEO succession on CER from the perspectives of external supervision and internal board risk sensitivity.

The potential contributions of this study are as follows: First, by integrating impression management theory from social psychology with the role of the CEO as a strategic core decision-maker in management, the study reveals that successor CEOs also engage in impression management. They do so by implementing short-term, quick-win decisions to enhance their image within the board and among external stakeholders, effectively alleviating “career concerns” due to the legitimacy pressures they face after assuming office. Thus, the study deepens the understanding of impression management theory and extends its application within the management field.

Second, by examining the relationship between successor CEOs and CER from the perspective of leadership turnover, the study expands the literature on the economic consequences of CEO succession. Previous research often measured managerial psychological characteristics using static demographic variables (Saesen et al., 2024; Wang et al., 2016). This study fills a gap in the literature by offering a dynamic perspective on CEO turnover, addressing the shortcomings of prior studies based on upper echelons theory, which fails to fully reflect the dynamic changes in individual emotions, situations, and behaviors over time.

Third, as a primary participant and driver in the market economy, and a major consumer of natural resources, enterprises play a leading role in environmental governance. How to enhance companies’ willingness to fulfill environmental responsibilities and improve sustainability has become an important topic in both theory and practice. This study provides empirical evidence from the corporate governance perspective on the antecedents of CER, focusing on the CEO as a key decision-maker. Additionally, the findings offer practical insights for companies and external stakeholders, such as investors, in setting internal performance evaluation criteria and understanding the successor CEO’s decision-making motives. This will help companies better fulfill their environmental responsibilities and enhance environmental performance.

Theory and hypothesis

Impression management theory

In sociopsychological research, impression management refers to the process by which an individual designs, modifies, and alters their behavior to control the impressions others form of them (Yuthas et al., 2002). In corporate strategy and management studies, impression management is considered a strategic tool, where a company actively improves and controls its image to achieve valuable objectives. It is also defined as “the control and manipulation of impressions conveyed to information users.” To gain resources and legitimacy from external stakeholders, companies often choose to engage in impression management to establish and maintain a favorable public image. Existing studies have found that companies use impression management to cope with declining performance, improve internal governance, and compete for scarce external resources and opportunities (Clatworthy and Jones, 2003). Even in the face of entrepreneurial failure, companies may use impression management strategies to mitigate the impact of negative events, such as reputation crises, caused by failure (Fisher et al., 2016). From the perspective of how impression management is manifested, research primarily analyzes its feasibility from the angle of information asymmetry, with positive information disclosure and corporate social responsibility receiving widespread attention (Chen et al., 2024; Hamza et al., 2023). Li et al. (2024b) found that companies use positive tones in their ESG reports to engage in impression management, misleading external investors’ perceptions of the company. Frutos-Bencze et al. (2024) showed that multinational companies use confident impression management strategies to attract the attention of various stakeholders in host countries when promoting innovation and implementing sustainable development goals.

This study extends the motivation for impression management from external stakeholders to the internal management level of the company. As a result of the board’s selection decision, a successor CEO’s continued appointment depends on further evaluation by the board. At this stage, the successor CEO, motivated by concerns about career stability, has a strong incentive to engage in impression management in the short-term to demonstrate their strategic decision-making and management capabilities to the board, gain internal recognition and respect, and secure a stable position within the company. Therefore, driven by the motivation for impression management, how the successor CEO views the company’s current environmental decisions becomes a key research question of great interest.

CEO succession in China’s institutional environment

For companies, CEO succession is a highly significant event. As the maker and implementer of corporate strategic decisions, the incoming CEO often brings substantial changes to the company’s prior strategy and development direction, and may even overturn previously designed strategic implementation models (Tao and Zhao, 2019). The highly competitive, market-driven environment has led to shorter CEO tenures, making CEO succession an important avenue for companies to address poor performance and shift strategic direction. Current research on CEO succession has extensively explored various aspects, including the driving factors behind CEO succession (Essman et al., 2021; Mooney et al., 2013), capital market reactions post-succession (Ballinger and Marcel, 2010; Cvijanovic et al., (2021)), and the impact of CEO succession on corporate strategy and decision-making (Schepker et al., 2017; Shaheen et al., (2023); Zhou, 2023).

In recent years, as the economic strength and visibility of Chinese-listed companies have continuously increased, CEO turnover has attracted more attention in both theoretical and practical fields. According to a survey on CEO turnover rates, in 2010, the global CEO turnover rate was 11.6%, while the rate in Chinese-listed companies was just 5.2%. However, within just four years, by 2014, the CEO turnover rate for Chinese-listed companies had skyrocketed to 15%, making it the highest in the world. The unique institutional characteristics of China provide an appropriate context for this study. In Chinese institutional and philosophical systems, the concept of “stability” holds great significance. From the governance ideologies historically promoted by ruling classes to the emphasis on the stability of land and climate in agricultural civilization, as well as the long-standing cultural tradition, “stability” has always been a central value. Driven by a strong pursuit of position stability, the successor CEO often exhibits a strong motivation for impression management during the board’s post-selection oversight phase. By demonstrating superior management and decision-making capabilities to the board, the successor CEO seeks to earn the respect of company members and establish their position within the company, avoiding the risk of career setbacks due to short-term decision-making mistakes.

CEO succession and corporate environmental responsibility (CER)

Impression management theory suggests that individuals in any organizational context desire to be positively viewed and recognized by others, and they take different actions in different situations to maintain their image (Graffin et al., 2011; Lee et al., 2020). The succession of a CEO involves a rigorous selection and evaluation process by the board, followed by a review and assessment to make decisions regarding dismissal or approval to ensure that the CEO’s professional capabilities align with the company’s internal and external environment and development goals (Liu, 2020; Zhang and Rajagopalan, 2004). In other words, a successor CEO, in the short-term, not only faces the pressure of gaining a competitive advantage and improving corporate performance but also the “career concerns” arising from board oversight and evaluation. This undoubtedly forces the CEO to make choices and trade-offs regarding resource allocation under the constraints of corporate resources. According to impression management theory, the successor CEO, in order to prove their managerial capabilities, gain the trust and recognition of the board, and eliminate the threat of departure, will choose strategic decisions that enhance their position stability. They will invest resources in strategies that yield quick results to achieve short-term performance improvements (Driver, Guedes, 2017; Liu et al., 2021). Simultaneously, the “quick win” hypothesis suggests that successor CEOs, driven by “quick win” motives, will opt for decisions that favor their interests, consciously directing resources towards actions that align with their short-term goals to establish authority and demonstrate capability (Chen et al., 2015).

Fulfilling environmental responsibilities often represents a high investment in the company’s limited resources (Li et al., 2020; Xu et al., 2018). Compared to investments in highly visible actions such as increasing product promotions or enhancing quality and safety measures, investments in improving pollution management or enhancing environmental management technologies have longer investment cycles. Additionally, for stakeholders such as shareholders, environmental measures are often seen as abstract information, with short-term returns not immediately apparent, making it difficult for the successor CEO to demonstrate managerial competence. Although fulfilling environmental responsibility can be beneficial in the long-term by gaining stakeholder recognition, enhancing corporate reputation, strengthening value creation, and improving the CEO’s image within the board (Liu, 2020; Gong et al., 2018), the successor CEO, due to limited authority and the short-sighted “quick win” mindset at the early stage of their tenure, tends to be more conservative and cautious in strategic decision-making. They are more likely to choose projects with high short-term returns and reduce long-term investments (Liu, 2023). Additionally, existing research has shown that CEOs may also exhibit a “strategic motivation” to fulfill environmental responsibility at the cost of shareholder interests and corporate value, thereby overspending on environmental responsibility to improve their personal reputation or gain personal benefits (Barnea and Rubin, 2010). If a successor CEO chooses to fulfill CER, it not only means abandoning some short-term strategies that yield quick results but also exposes them to accusations of opportunism and moral hazard (Ballinger and Marcel, 2010; Intintoli et al., 2014), which may result in decreased financial performance and shareholder losses. Consequently, the successor CEO would struggle to prove their competence to the board and shareholders in the short-term, establish authority in front of employees, and gain the recognition of the board and investors, all while failing to use “quick wins” to alleviate the threat of departure and solidify their position (Call et al., 2009). Therefore, under the influence of impression management and “quick win” motives, the successor CEO’s motivation to fulfill CER is weakened, and they are more likely to opt for other decisions to maintain position stability and avoid the threat of departure. Based on the above discussion, the following hypothesis is proposed:

Hypothesis 1: CEO succession has a negative impact on CER.

The moderating effect of external analyst coverage

External analysts are professionals with securities investment consulting qualifications who provide investors with research reports and investment recommendations for publicly listed companies. They serve as a bridge for information transmission in the capital market, offering valuable professional insights (Jens, 2017). With their specialized knowledge and skills, external analysts gather, process, and disseminate information about listed companies. By doing so, they expand the range of information available to investors, increase corporate exposure and visibility, and act as an external governance mechanism for monitoring corporate management. Existing research suggests that external analysts, through monitoring internal management, can effectively reduce the information asymmetry between companies and investors, improve the efficiency of market resource allocation (An et al., 2020), reduce earnings management (Sun, 2009), and curb moral hazard and opportunistic behavior by controlling shareholders and management (Anantharaman and Zhang, 2011). We propose that external analyst attention will strengthen the negative impact of CEO succession on CER, for the following reasons:

External analyst attention brings greater exposure to the company but also increases the scrutiny of the successor CEO (Connelly et al., 2016). The successor CEO faces not only the potential threat of a change in position from the board but also the psychological uncertainty from external market investors and analysts, who may become more inclined to negatively evaluate the successor CEO’s early performance due to concerns about the unclear future prospects following the CEO change (Jung, 2017). This increases the external attention on the successor CEO, and such external evaluations significantly influence the board’s decisions regarding dismissal or retention. Under these internal and external pressures, the successor CEO, considering their limited power and high position uncertainty (Ballinger and Marcel, 2010), experiences a stronger impression management motive, with a greater desire to achieve “quick wins” in the short-term to demonstrate capability.

Given that fulfilling environmental responsibilities demands a significant allocation of resources, has slow short-term returns, and is often seen as yielding less immediate benefits, it may also attract suspicion and criticism from external market investors and analysts due to the potential for “strategic motivations” aimed at personal gain. As a result, to gain recognition for their capabilities and alleviate negative external evaluations, the successor CEO is likely to “appease” external market investors and analysts by reducing resource allocation to environmental initiatives and minimizing CER. Instead, they would prioritize short-term high-return investments to improve corporate performance. This approach sends a signal to both internal and external stakeholders that the successor CEO is capable of managing the company, helps dissipate doubts among external investors and analysts, boosts confidence in the successor, and reduces negative judgments and reports. Consequently, this may lead to a relaxation of board-level oversight and alleviate the successor CEO’s “career concerns,” helping to maintain position stability (Marquis and Tilcsik, 2013). Based on the above discussion, we propose the following hypothesis:

Hypothesis 2: External analyst coverage strengthens the negative impact of CEO succession on CER.

The moderating effect of predecessor CEO tenure

We hypothesize that the tenure of the predecessor CEO will also strengthen the negative impact of CEO succession on CER. The reasoning is as follows: First if the successor CEO allocates more resources to environmental responsibility, it does not simply mean eliminating high-energy, high-pollution fixed assets, developing and purchasing clean production equipment, or increasing costs for pollution control and management. The key issue is that a long-tenured predecessor CEO tends to create a relatively fixed set of interest groups and structures due to their decision-making characteristics (Liu and Atinc, 2021). To ensure the proper execution of environmental responsibility, the successor CEO must break away from the behavioral routines and structural patterns established by the predecessor CEO, integrating the relevant responsible departments. In the short-term, this will demand significant effort and disrupt the established interest groups and patterns within the company, increasing resistance to inter-departmental collaboration and potentially causing internal conflicts and power struggles within the executive team (Li et al., 2009; Ballinger and Marcel, 2010). Ultimately, this may introduce volatility and risk to the company’s smooth development, reducing the board’s risk tolerance and intensifying the successor CEO’s threat of dismissal and “career concerns”.

Second, the tenure of the predecessor CEO directly influences the board’s risk sensitivity. As the originator and executor of previous strategic decisions, the background and perspectives of the predecessor CEO significantly impact the company’s future development and resource allocation direction. As the predecessor CEO’s tenure lengthens, the board becomes more familiar with their performance, which reduces the need for supervision and the intensity of oversight (Deng and Lin, 2014). When a long-tenured CEO leaves, the resulting short-term disruption in management and stagnation in strategic direction raises the board’s perception of risk. This increased risk sensitivity, combined with uncertainty regarding the company’s future, is transferred to the successor CEO through intensified supervision and evaluation, as the board uses these measures to “ease” their own concerns (Karaevli and Zajac, 2013). Therefore, if the predecessor CEO’s tenure is long, the successor CEO will face greater difficulty in fulfilling environmental responsibilities and will be subject to more intense evaluation by the board. In this scenario, the successor CEO’s impression management motives are further strengthened, and they are more likely to pursue “quick wins” to improve short-term performance, alleviate “career concerns,” and reduce the threat of dismissal, ultimately decreasing their willingness to fulfill CER. Based on the above discussion, we propose the following hypothesis:

Hypothesis 3: The tenure of the predecessor CEO will strengthen the negative impact of CEO succession on CER.

The overall study model is shown in Fig. 1.

Hypothesized model.

Variable definitions and data

Data and sample selection

This study selects A-share listed companies from the Shanghai and Shenzhen stock exchanges between 2010 and 2023 as the research sample, with the following processing steps: (1) Companies that underwent major restructuring events, such as changes in the controlling shareholder, during the observation period were excluded; (2) Financial companies were excluded; (3) Companies marked as ST or *ST were excluded; (4) Companies with significant missing data were excluded. Additionally, considering the potential endogeneity issues in the model and the fact that the impact of CER tends to manifest with a delay, the study uses the T + 1 period (2011–2023) for the dependent variable (CER) and the T period (2010–2022) for the other variables. After matching, a final sample of 9,214 company-year non-balanced panel data points was obtained. To mitigate the impact of outliers, the study applies a 1% quantile winsorization to continuous variables with extreme values. Environmental responsibility data is sourced from companies’ annual financial reports and notes, while other data is obtained from the Wind (https://www.wind.com.cn) and CSMAR databases (https://data.csmar.com/).

Dependent variable: corporate environmental responsibility (CER)

Corporate environmental responsibility (CER) refers to the obligations that a company must comply with environmental laws and regulations throughout its life cycle, aiming to minimize resource utilization and pollution emissions. It involves both mandatory and voluntary behavior norms that promote the coordinated development of economic and social environments. Current measures of environmental responsibility often rely on proprietary databases such as KLD, which primarily provide data for U.S. companies. However, some scholars argue that using actual corporate environmental expenditures is an effective way to measure environmental responsibility, as the monetary investment data better reflects a company’s willingness to engage in environmental participation and governance (Quan et al., 2018). Unfortunately, existing databases do not provide detailed data on corporate environmental expenditures. To address this, we follow the approach used by previous scholars (Lin and Zhang, 2023) and attempt to analyze corporate annual financial reports and notes, identifying and calculating the expenditure data related to environmental protection projects. We then take the natural logarithm of these figures to mitigate the impact of heteroscedasticity.

Independent variable: CEO succession (succession)

We refer to the existing research and take whether CEO succession (Succession) occurs in the current year as the independent variable (Liu, 2020). In order to avoid measurement errors, we also downloaded the annual report of the sample company from the company’s website and checked the results in the database with the enterprise’s annual report. In order to reduce the ambiguity of the definition, we define the general manager, president and chief executive officer in the annual report as the category of CEO. We set the CEO succession as a 01-dummy variable. If the CEO succession occurred in the listed company in the current year, the ‘Succession’ is defined as 1; otherwise, it is 0.

Moderating variables

There are two main moderating variables in this paper. The first moderating variable is external analyst coverage. In measurement, based on the practice of Hu et al. (2021), we selected the total number of external analysts in the current year plus 1 to calculate the logarithm. As there are specific differences in enterprises’ scale and operating characteristics, the number of analyst coverage faced by different enterprises is also very different. Taking the logarithm of the number of external analysts can effectively reduce the selectivity error of the sample.

The second moderating variable in our study is the tenure of the predecessor CEO (P_year). We selected CEO characteristic data from the CSMAR database and measured the tenure of the predecessor CEO before CEO succession, converting months into years. For missing data, we verified and matched the information using the annual reports of listed companies and financial websites. If data could not be obtained, we excluded those sample companies from the analysis.

Control variables

Following the approach of previous studies (Liu, 2020; Meng et al., 2024; Xu et al., 2022), the control variables selected in this study are as follows: First, existing research suggests that a company’s financial condition significantly influences its subsequent strategic decisions. Therefore, we control for the company’s return on assets (ROA), debt ratio (Leverage), and growth potential (Growth). Second, as owners of the company, shareholders’ equity structure and ownership size can affect the management’s decision-making willingness and supervision intensity, thus influencing the company’s strategic direction. To account for this, we further control for equity concentration (EC), equity balance (EB), and the proportion of institutional investors (Invest). Considering that the company’s equity incentive plan may increase management’s risk tolerance, aligning management and shareholders’ interests, we also control for management shareholding ratio (MS). Third, from a corporate governance perspective, the size and composition of the board of directors can affect both the directors’ risk sensitivity and the decision-making preferences of the company’s executives. Therefore, we control for leadership structure (LS), board size (BS), and board independence (BI). Fourth, recognizing that a company’s size and characteristics may influence its environmental strategy, we also control for company size (Size) and age (Age). Finally, we control for industry and year-fixed effects. The detailed definitions of the variables are shown in Table 1.

Data analysis and results discussion

Empirical model design

To test the hypotheses of this paper, we design the following OLS panel regression model:

In this study, Model 1 represents the regression of control variables on CER. Model 2 examines the impact of CEO succession on CER, which tests Hypothesis 1. Model 3 builds upon Model 2 by adding external analyst coverage and the interaction term between external analyst coverage and CEO succession to analyze the moderating effect of external analyst coverage on the relationship between CEO succession and CER, thereby testing Hypothesis 2. Model 4 adds the predecessor CEO tenure and the interaction term between predecessor CEO tenure and CEO succession to Model 1 to analyze the moderating effect of predecessor CEO tenure on the relationship between CEO succession and CER, testing Hypothesis 3. Additionally, as mentioned earlier, the dependent variable (CER) is taken for the T + 1 period, and the other variables are taken for the T period. The study employs OLS panel regression to test the hypotheses, and Stata 15 software is used for data analysis.

Descriptive statistics and correlation analysis

The descriptive statistics and correlation analysis of the variables are presented in Table 2. The average value of CER is 19.606, with a standard deviation of 1.223, reflecting a significant variation in the level of environmental responsibility fulfillment across the sample companies. The average value of CEO succession is 0.218, indicating that CEO succession, as a non-routine management change event, occurs infrequently across companies. The average tenure of the predecessor CEO is 4.280 years, suggesting that predecessor CEOs have relatively long tenures, and their decision-making characteristics likely influence the company’s development approach and resource allocation strategies.

We conducted an industry-level analysis of the sample, and the results are shown in Table 3. In the 9214 company-year panel data sample, the manufacturing sector has the largest number of samples, with 5449, accounting for 59.14% of the total sample. The remaining sectors each account for less than 10% of the sample, with the smallest number of samples from the residential services, repair, and other service industries, representing only 0.04% of the dataset.

From the correlation analysis of the variables in Table 4, CEO succession is negatively correlated with CER (−0.048), and this relationship is significant at the 1% level, which is consistent with the main effect hypothesis. Since the correlation coefficient matrix only shows pairwise correlations between variables, further regression analysis is necessary to verify the regression coefficients between the variables and their alignment with the expected hypotheses for both main and moderating effects.

We also conducted a variance inflation factor (VIF) test, and the results are shown in Table 5. The average VIF is 1.63, with a maximum value of 2.91, and all individual variables have VIF values less than 3, well below the threshold of 10. This indicates that the model used in this study is not affected by multicollinearity.

Multiple regression results

The regression analysis results are presented in Table 6. Model 1 shows the regression results of the control variables on CER. It can be seen that the vast majority of the control variables are highly significant, indicating that the selected control variables are reasonable. From the results of the control variables, we find that the return on assets (ROA) and growth potential (Growth) are negatively related to CER. This may be because higher returns and growth rates often imply that shareholders have higher return expectations from management, which may lead the management to focus more on short-term performance. As a result, resources are more likely to be allocated to high-return projects, while environmental responsibility often requires significant upfront investment and has a longer return cycle, which could conflict with the company’s goal of maintaining operational performance growth. Institutional investors have a positive impact on CER, indicating that institutional investors typically have long-term investment goals and risk awareness, and thus place more emphasis on a company’s sustainable development ability. The board size also has a positive effect on CER, suggesting that a larger board, which often brings more diverse knowledge and experience, can help the company gain external policy guidance and environmental technology support through the board’s social resources. The results related to independent directors indicate that they tend to provide a more objective perspective on company behavior, avoiding short-term profit-driven decisions, and promoting a focus on long-term environmental sustainability. Additionally, the regression results for company size and age show that larger companies and those with longer listing periods tend to be more mature in their management and operations. These companies are more likely to focus on long-term development and invest more funds in environmental protection and green technology upgrades. Additionally, larger companies generally have more influence in society and are more likely to be subject to public and policy attention and oversight. This external pressure encourages companies to place more emphasis on environmental responsibility in order to enhance their legitimacy and brand reputation in the public eye.

Model 2 presents the regression results of CEO succession on CER. The coefficient of CEO succession is significantly negative (β = −0.162, p < 0.01), indicating that CEO succession has a significant negative impact on CER. This suggests that, following their appointment, successor CEOs, under the board’s evaluation and the threat of dismissal, are driven by impression management and “quick win” motives. They tend to focus their efforts on decisions that can improve short-term operational performance while postponing investments in environmental prevention and the construction and upgrading of environmental protection facilities. Therefore, Hypothesis 1 is supported. Model 3 adds external analyst coverage and the interaction term between the successor CEO and external analyst coverage. The coefficient of the interaction term is significantly negative (β = −0.065, p < 0.01), indicating that the level of external analyst attention amplifies the negative impact of CEO succession on CER. The higher the external analyst’s attention, the greater the exposure and scrutiny of the successor CEO’s abilities. Due to concerns about their limited power and job stability, the motives for impression management and “quick wins” are further strengthened, which in turn reduces their willingness to prioritize environmental responsibility. Hence, Hypothesis 2 is supported. Model 4 introduces the predecessor CEO tenure and the interaction term between successor CEO and predecessor CEO tenure. The coefficient of the interaction term is significantly negative (β = −0.011, p < 0.05), indicating that the predecessor CEO’s tenure also strengthens the negative impact of CEO succession on CER. The longer the predecessor CEO’s tenure, the more stable the internal management structure becomes, which creates resistance for the successor CEO in implementing environmental strategies. Additionally, the board, due to its heightened sensitivity to potential future risks, may increase its supervision over the successor CEO, thereby reducing the successor’s willingness to fulfill environmental responsibilities. Therefore, Hypothesis 3 is also supported.

Robustness test: Replacing the dependent variable

Following the approach of previous studies (Meng et al., 2024), we use a company’s environmental management level as a proxy for CER. Specifically, we measure the company’s environmental management level based on the following six dimensions: environmental philosophy (disclosure of the company’s environmental policies, environmental management organizational structure, circular economy development model, green development situation); environmental goals (disclosure of the company’s past achievements in meeting environmental goals); environmental management system (disclosure of the company’s designated environmental management systems, frameworks, and responsibilities); environmental honors and awards (disclosure of the company’s honors and awards in environmental protection); environmental education and training (disclosure of the company’s participation in environmental-related education and training); and emergency mechanisms for environmental incidents (disclosure of the company’s emergency response mechanisms for major environmental incidents, emergency measures taken, and pollutant treatment practices).

We used a scoring method to calculate the environmental management level. If the company disclosed information in any of these dimensions, we assigned a score of 1; otherwise, it was assigned a score of 0. Since the resulting variable is a count variable, we used a Poisson regression method for the analysis. The results are shown in Table 7. As seen in columns 1–3 of Table 7, the regression results remain robust.

Propensity score matching (PSM) test

Given the potential sample selection bias in the model, we further use the Propensity Score Matching (PSM) method for robustness checks. Specifically, we selected the following covariates: company size (Size), company age (Age), return on assets (ROA), debt ratio (Leverage), revenue growth rate (Growth), equity concentration (EC), equity balance (EB), and the proportion of management shareholding (MS). We employed a 1:1 nearest-neighbor matching method. The regression results after matching are shown in Table 8. As seen in columns 1–3 of Table 8, after applying PSM, the regression results still exhibit high statistical significance.

Excluding the impact of the New Environmental Protection Law

On January 1, 2015, China implemented the New Environmental Protection Law. The enactment of this law strengthened corporate pollution prevention responsibilities, increased the costs of environmental violations, established an environmental credit system, and introduced an environmental impact assessment system, which raised the costs of corporate non-compliance and forced companies to fulfill environmental responsibilities to enhance their legitimacy with stakeholders such as the government and the public. We recognize that the New Environmental Protection Law could potentially interfere with the conclusions of this study. Therefore, we further controlled for the effect of the law by introducing a dummy variable (EPL_new), which takes the value of 1 for samples after 2015 and 0 otherwise. The test results are shown in Table 9. As seen in columns 1–3 of Table 9, after controlling for the potential impact of the New Environmental Protection Law, the research conclusions remain robust.

Endogeneity test

Considering the potential endogeneity issues in this study, such as omitted variable bias or reverse causality, where poor CER performance may lead to CEO changes, we use an instrumental variable (IV) approach for testing. Based on the correlation and exogeneity requirements of instrumental variables, we choose the average number of CEO changes in the industry within the same region (CEO_change) as the instrument. Specifically, this variable represents the average number of CEO changes in the same industry within the same province or municipality, excluding the target company. The rationale for selecting this instrument is twofold. First, the average number of CEO changes in the same region can reflect the board’s assessment style and personnel arrangements in that region, which might have similarities across companies. This regional and industry-specific CEO turnover can influence the succession process of the target company’s CEO, fulfilling the instrument’s relevance requirement. Second, CEO changes in other companies do not directly affect the environmental responsibility of the target company, fulfilling the exogeneity requirement.

We apply the Two-Stage Least Squares (2SLS) regression to verify the hypotheses. The results are shown in Table 10. The first-stage results indicate that the CEO regional change variable significantly positively affects the target company’s CEO succession (β = 0.564, p < 0.01). The weak instrument test shows an F-statistic of 45.52, well above the critical value, indicating that the chosen instrument does not suffer from weak instrument issues. The second-stage results show that the regression coefficient of CEO succession on CER remains significantly negative (β = −2.461, p < 0.05), suggesting that the regression model does not suffer from severe endogeneity issues.

Discussion

Environmental issues not only pose a severe threat to human survival but also have a significant impact on climate and ecosystems, making them a global challenge that humanity must address. In fact, achieving sustainable environmental governance is a complex social system project that requires joint efforts from all parties. Among these, enterprises, as the main participants in the market economy, have played a crucial role in driving the rapid development of China’s market economy, while also serving as key actors in the extraction of natural resources and environmental governance. How to motivate companies to actively fulfill their environmental responsibilities and achieve a win-win situation for both economic benefits and ecological protection has become an important issue in both theory and practice. As the main planners and implementers of corporate green strategies, the role of the CEO is crucial in shaping a company’s attitude toward environmental decision-making.

The current study acknowledges the role of various executive characteristics in corporate strategic decision-making. However, an analysis of the existing literature reveals that most scholars have approached corporate decision-making from a static demographic perspective (Saesen et al., 2024; Wang et al., 2016), often overlooking the dynamic features of CEO succession and its impact on environmental decision-making. While some research has focused on the significant phenomenon of management turnover and has extensively discussed its antecedents and economic consequences (Ansari et al., 2021; Barron et al., 2011; He, Fang, 2016; Louca et al., 2020), this study distinguishes itself in several ways. For one thing, from a theoretical perspective, existing research on the economic consequences of CEO succession often emphasizes the risk-averse motivations of new management. For instance, studies have explored how CEO succession and management changes impact corporate strategic transformation (Barron et al., 2011), earnings management (Ansari et al., 2021), and internationalization (Lin and Liu, 2011). Building on these studies, this research innovatively integrates impression management theory and the “quick win” hypothesis into the framework. We find that newly appointed CEOs, driven by concerns about job stability, tend to make more conservative decisions and exhibit strong impression management motives. Specifically, they focus on projects that deliver visible short-term benefits while reducing investment in environmental responsibility, a long-term investment, to achieve “quick wins” and demonstrate their management abilities to the board. For another, this study combines the dynamic characteristic of CEO turnover with the increasingly important corporate environmental strategy. By analyzing the impact of CEO succession on CER, the study expands the understanding of the factors influencing corporate environmental decision-making from a dynamic perspective, extending the boundary conditions of the relationship between CEO succession and environmental responsibility by incorporating external analyst attention and the tenure of the predecessor CEO.

Based on data from Chinese A-share listed companies, the hypotheses proposed in this study have been empirically supported. Overall, in the context of the national “dual carbon” strategy and the push for corporate sustainable development, our study deepens the understanding of decision-making motivations following management changes. It also provides new insights for both internal and external governance bodies and stakeholders on how to interpret management changes and the decision-making attitudes of corporate leadership.

Conclusions

In the current macroeconomic context, where the government is vigorously promoting environmental pollution control and pushing for corporate sustainable development, it is crucial for companies to actively engage in environmental management. Fulfilling environmental responsibilities is not only a necessary requirement to meet the legitimacy of external stakeholders but also a key method for cultivating green development momentum and enhancing market competitiveness. Based on impression management theory and the “quick win” hypothesis, this paper explores the impact of CEO succession on CER and examines the moderating effects of external analyst attention and the tenure of the predecessor CEO. Using Chinese A-share listed companies from 2010 to 2023 as the research sample, we constructed a proxy variable for CER by manually retrieving financial report notes from company annual reports. The results show that CEO succession has a negative impact on CER, and both external analyst attention and predecessor CEO tenure strengthen the relationship between CEO succession and CER.

Theoretical contributions

First, this study expands the application of impression management theory from an interdisciplinary perspective. Originally developed in behavioral psychology, impression management refers to the process by which an individual influences others’ perceptions of themselves through certain behaviors. In the context of corporate strategy and management, impression management is often viewed as a strategic tool, where companies actively adjust and control their image to achieve specific goals. Our study extends the motivation for impression management from external stakeholders to internal managers, integrating impression management theory with the role of the CEO as a strategic core decision-maker. We find that successor CEOs also exhibit impression management motives. Due to concerns about their career stability, successor CEOs tend to focus their efforts on short-term, visible projects to gain approval from the board and external stakeholders, while reducing investment in environmental responsibility, a long-term, uncertain strategic decision. By examining CEO turnover from a dynamic perspective, this research deepens our understanding of impression management theory in the context of corporate leadership transitions.

Second, this study further enhances our understanding of successor CEOs and expands the literature on the economic consequences of CEO succession by linking successor CEO characteristics to corporate environmental decision-making. Existing research on the impact of managerial characteristics on corporate decisions often focuses on the static demographic characteristics of management, with less attention paid to the dynamic changes within management (He, Fang, 2016; Louca et al., 2020). Moreover, while some studies explore the antecedents of CEO turnover, such as poor company performance or managerial opportunism (Ansari et al., 2021; Barron et al., 2011), they primarily analyze CEO succession in the context of market strategies, rather than addressing non-market decisions, such as environmental responsibility. This study fills this gap by examining the impact of CEO succession on CER.

Third, this research provides empirical evidence from a corporate governance perspective regarding the antecedents of CER. Existing research typically analyzes environmental responsibility by considering the company as a whole, focusing on the impact of external environmental regulations and the influence of capital market participants (Li et al., 2024a; Ming et al., 2023). However, there has been limited focus on separating corporate decision-making from individual managers. The upper echelons theory suggests that corporate decisions often reflect the will of senior executives. By examining the internal characteristics of executives, this study reveals that successor CEOs, driven by their pursuit of “quick wins” and concerns about career stability, may reduce the company’s willingness to fulfill environmental responsibilities. Thus, the study enriches the understanding of the factors influencing CER by incorporating the career concerns of internal decision-makers.

Practical implications

First, for boards of directors, while fulfilling their internal governance and oversight roles, it is essential to establish a scientifically sound and moderate supervision and evaluation mechanism for successor CEOs. Boards should increase their tolerance for the risks associated with successor CEO decisions, use appropriate growth and incentive measures, and even incorporate environmental responsibility performance into the successor CEO’s performance evaluation system. This encourages successor CEOs to broaden their perspectives and avoid relying solely on short-term financial metrics to assess their management capabilities. Second, successor CEOs should strengthen their awareness of green responsibility and long-term development. They must recognize that environmental responsibility is a core part of the company’s strategic agenda. While focusing on career stability, successor CEOs should also understand the powerful driving force that environmental responsibility has on the company’s long-term development and its ability to capture green competitiveness. They should view environmental responsibility as a means of proving their management abilities and avoiding excessive risk aversion that could result in missed development opportunities. Third, CER in China is still in its early stages, and overall awareness of environmental protection needs to be improved. Continuous efforts are required to establish and perfect relevant environmental laws and systems, with clear and detailed regulations on CER. For environmental issues that companies are unwilling or unable to address, mandatory provisions should be enforced. This will not only enhance overall environmental awareness but also facilitate better oversight by external regulatory agencies, intermediaries, and the public, maximizing the role of external governance mechanisms.

Limitations and future research

Indeed, this study has several limitations, but it also opens up potential avenues for future research. First, in terms of measuring environmental responsibility, although we have collected and analyzed detailed data from annual reports of listed companies, environmental responsibility also includes industry standards and ethical dimensions. Future research could attempt to construct a comprehensive environmental responsibility index by incorporating concepts such as financial expenditures, external evaluations, and environmental ethics. Second, due to the limitations in sample availability, this study focuses solely on Chinese-listed companies. Future studies could explore emerging markets or non-listed companies as research samples, to examine differences in environmental responsibility behaviors across regions and company types. Finally, this study mainly explores the relationship between CEO succession and corporate environmental responsibility, but corporate strategic decisions are often not made by the CEO alone. They are influenced by other executives and board members. Future research could consider the executive team as a whole, investigating how the overall turnover and stability of the executive team impact corporate environmental decision-making.

Responses