Revolutionizing finance with conversational AI: a focus on ChatGPT implementation and challenges

Introduction

Financial Technology (FinTech) is defined as applying digital technology in the financial business to provide innovative financial products and services (Yang et al. 2023). With the advancement of digital technology, the global FinTech market has been growing at a rate over the past few years (Liu et al. 2020). It highlights the potential of digital technology in the financial sector. There are many successful cases of fintech innovations. For example, Alipay and WeChat Pay have become popular in China and are the primary payment methods for daily consumption (Mombeuil and Uhde 2021). Additionally, offering clients diverse portfolios using intelligent investing platforms like Betterment and Wealthfront has altered conventional investment notions (Shanmuganathan 2020).

As a result, the financial industry has seen significant shifts because of digital technology. Exploring ways to use digital technology has emerged as a key study area to improve further financial services and products (Choi and Kim 2023; Feng et al. 2022). In this setting, ChatGPT and other intelligent interaction systems can promote financial inclusion, improve customer experience, and advance the FinTech industry (Singh and Joshi 2023).

The financial industry may use ChatGPT in a variety of ways (Ali and Aysan 2023). By automating client query responses, financial institutions may increase customer service effectiveness, save staff expenses, and improve user experience. It may also predict and analyze data to assist financial organizations in better understanding market trends and investment possibilities. Additionally, ChatGPT may provide clients with individualized financial advice, delivering exact direction depending on client preferences. Finally, ChatGPT is crucial to risk management since it offers information to assist financial professionals with risk analysis and evaluation.

However, care must be taken to ensure the confidentiality and safety of financial data while using ChatGPT in the financial sector (Khan and Umer 2023). Data encryption, access control, and authentication are necessary during model training to reduce the danger of information leakage and hacking. The interpretability of models is also an important issue. Interpretability helps financial practitioners understand the model’s decision-making process, reduce uncertainty, and increase trust in the model output. Furthermore, although ChatGPT performs well in numerical reasoning tasks, it still has limitations in sentiment analysis tasks (Li et al. 2023). Hence, ChatGPT needs to be used with an awareness of its strengths and weaknesses based on the needs of a specific task.

The study of ChatGPT is of great significance in the financial field. It enhances customer experience, personalizes services, and helps users understand financial products and investment opportunities while strengthening the risk management capabilities of financial institutions (Chen et al. 2023). Moreover, this research is expected to contribute to FinTech development and promote the financial industry’s success in the digital era.

Some gaps in ChatGPT research need to be filled in the financial sector. There are limited empirical studies, and more verification of its practical effects is needed. Beyond that, there are still challenges in understanding complex financial contexts and providing accurate risk assessments. Therefore, further research should focus on filling these gaps to enhance the ability of ChatGPT in finance.

To address these gaps, this study focuses on the following research questions:

-

1.

How effective is ChatGPT in improving customer service efficiency in financial institutions?

-

2.

What methodologies can be employed to build and optimize ChatGPT for financial risk assessment?

-

3.

How can financial institutions ensure data privacy and security while deploying ChatGPT?

-

4.

What strategies can mitigate model bias and ensure the ethical use of ChatGPT in financial services?

This study will proceed as follows: We will briefly introduce how ChatGPT works and summarize the related research literature. The next section introduces the research method. Subsequently, we will delve into the practical application of the technology in financial services and explore the management of AI applications in financial services organizations. Besides, the study will also discuss the ethical considerations involved in applying ChatGPT. Finally, it will present an agenda for future research to promote the further development of ChatGPT in financial services.

Overview of the study

Chatgpt model

ChatGPT is a deep learning-based language model that uses the transformers model architecture for powerful language generation and comprehension (Kasneci et al. 2023). Learning takes place through two phases: pre-training, which uses a large amount of unsupervised data to learn the structure and semantics of the language, and fine-tuning, which uses a small amount of supervised data to optimize the model for a specific task (Cheng et al. 2023). ChatGPT generates humanized responses, is iterative and extensible, but may have comprehension limitations for domain-specific knowledge. In addition, it may encounter difficulties in handling erroneous or inappropriate requests. ChatGPT can be applied to personal assistants and online customer service content generation.

GPT-3.5 is a transitional version of the GPT series of models between GPT-3 and GPT-4. It improved and optimized GPT-3 and paved the way for the release of GPT-4 (Stahl and Eke 2024). The most recent and sophisticated version, GPT-4, offers more outstanding performance and quality in language creation and understanding than GPT-3.5. Similar architecture and training methods are used, but the model’s quality and effectiveness are increased.

To better understand ChatGPT’s unique role, it is essential to compare it with other AI tools used in financial services. Traditional AI tools, such as rule-based chatbots and predictive models, often rely on pre-programmed rules or structured data to perform specific tasks. These tools, while effective for well-defined problems, lack the flexibility to handle nuanced, unstructured, and context-rich inputs (Kasneci et al. 2023).

In contrast, ChatGPT, built on the GPT architecture, leverages deep learning and large-scale natural language processing (NLP) capabilities to process vast amounts of unstructured data, such as financial news, reports, and user queries. Unlike traditional AI tools, ChatGPT can generate human-like, dynamic responses and adapt to complex conversational contexts, enabling it to support tasks like financial planning, portfolio analysis, and fraud detection more effectively (Lo and Singh 2023).

Moreover, ChatGPT’s iterative learning and real-time adaptability distinguish it from specialized AI tools that are often task-specific. For example, traditional fraud detection systems rely on rigid pattern recognition, whereas ChatGPT can combine historical analysis with natural language inputs to provide real-time insights into suspicious activities ((Zaremba and Demir 2023).

However, it is important to acknowledge that while ChatGPT exhibits significant advantages in flexibility and conversational ability, it still faces challenges such as model bias and the need for human oversight, which are shared with other AI tools (Borji 2023). This comparison highlights ChatGPT’s potential to enhance AI applications in finance by addressing unstructured data and providing more human-like interactions.

Theoretical perspective

The Efficient Market Hypothesis (EMH) posits that financial markets are “informationally efficient,” meaning that asset prices fully reflect all available information at any given time (Fama 2017). This implies that, in an efficient market, it is impossible to consistently achieve returns higher than the overall market without assuming additional risk. Prices should adjust immediately to new information, which is reflected in the asset prices.

ChatGPT, as an advanced AI model with sophisticated natural language processing capabilities, has the potential to enhance market efficiency by improving information dissemination and accessibility. ChatGPT can analyze vast amounts of unstructured financial data, including news articles, earnings reports, and market analyses, and provide summarized, real-time insights (Lo and Singh 2023). This reduces information asymmetry—a key factor in market inefficiency—and enhances the speed at which market participants can access and process relevant data. ChatGPT’s real-time capabilities allow for faster decision-making and better market reactions to new information, which theoretically aligns with the principles of EMH. However, the effectiveness of ChatGPT’s contributions is highly dependent on the quality and accuracy of the data it processes. Errors or biases in the data could be propagated, leading to skewed insights and potentially affecting the accuracy of market predictions (Zaremba and Demir 2023).

Investor Behavior and Decision-Making. While EMH assumes that investors act rationally, behavioral finance provides a more nuanced understanding by recognizing that investor behavior is often influenced by cognitive biases, such as overconfidence, loss aversion, and herd behavior (Kahneman and Tversky 1979). ChatGPT can mitigate some of these biases by providing objective and data-driven analyses, thereby offering investors a more balanced perspective (Ullah et al. 2024). For instance, ChatGPT could help investors make more informed decisions by analyzing market sentiment, financial trends, and individual preferences, without being swayed by emotional biases.

However, ChatGPT may also introduce new challenges. For instance, if investors rely heavily on AI-driven outputs without critical evaluation, this could result in over-reliance on automated predictions, leading to homogenized strategies across market participants. This aligns with the notion in behavioral finance that, while rational decision-making is ideal, in practice, human biases often distort judgments. In this context, ChatGPT’s role is to support investors in making rational decisions, but it cannot eliminate the risks associated with human behavior (George and George 2023).

Market Anomalies and Predictive Analysis. Despite the EMH, various market anomalies have been documented, such as momentum effects and mean reversion (Jegadeesh and Titman 1993). These anomalies challenge the idea that market prices always reflect all available information. ChatGPT’s advanced analytical capabilities, particularly its ability to process big data and detect patterns in historical market behavior, may help identify and explain these anomalies. For instance, ChatGPT can assist in uncovering hidden correlations in financial data that are difficult for human analysts to detect.

However, while the integration of AI tools like ChatGPT into market analysis can uncover these anomalies, it also introduces the risk of homogenizing trading strategies. As more investors adopt AI-based tools, there is a risk that AI-generated strategies will converge, potentially reducing the diversity of market strategies. This could, in turn, dampen the effects of traditional market anomalies, such as momentum or mean reversion.

Empirical Evidence and Practical Implications. Recent empirical studies have explored the intersection of AI and market efficiency. Research indicates that AI-driven analyses can uncover value in smaller stocks and undervalued assets, potentially challenging traditional EMH assumptions that all available information is reflected in asset prices. For instance, AI tools like ChatGPT have been shown to improve decision-making accuracy and identify investment opportunities that might be overlooked by human analysts, especially in under-researched markets (Kim et al. 2023).

However, the increasing use of AI-powered tools across the financial sector presents a dual-edged sword: while they improve efficiency and accessibility, they also increase the risk of algorithmic convergence—the idea that similar tools could lead to identical decision-making patterns, thus reducing market diversity and increasing market volatility (Zaremba and Demir 2023). Therefore, while ChatGPT has the potential to improve market efficiency, it also introduces new complexities to market behavior that require further empirical study.

Technology integration

The efficiency and competitiveness of corporate finance plans may be further improved by integrating ChatGPT with technologies like blockchain and big data. Here are a few potential integration strategies:

Smart contracts and distributed ledgers are two features that blockchain technology can offer. Combining ChatGPT with blockchain enhances data security and traceability (Wang et al. 2023). Companies can use ChatGPT to query and interpret financial data stored on the blockchain, providing accurate information retrieval and analysis. Further, ChatGPT can interact with smart contracts to automate contract execution and financial transactions.

Combining ChatGPT with big data technology can provide diverse data sources to enhance the accuracy and personalization of their answers (Zaremba and Demir 2023). Organizations can use big data analytics to predict market trends, risk assessments, and financial advice. Integrating these analytics into ChatGPT can yield more targeted services and customer advice.

Research methodology

In this study, we employed a qualitative research approach, using simulated dialogues between users and ChatGPT, supplemented with case study analysis, to explore the potential applications of the AI tool in the financial services sector. This section outlines the rationale behind the choice of methods, the design of the simulations, the incorporation of real-world case studies, and the limitations of this approach.

Rationale for simulated dialogues

The primary aim of this research is to investigate how ChatGPT can be applied in various financial services areas, such as customer service, financial planning, risk management, and fraud prevention. Simulated dialogues were chosen as the main method due to their ability to capture and represent realistic interactions between users and the AI tool. These scenarios were designed based on real-world use cases within the financial industry, offering insights into how ChatGPT might function in practice.

While simulated dialogues provide a useful theoretical foundation, they are intended to be a starting point for further empirical validation. The goal was to demonstrate the potential applications and benefits of ChatGPT across various domains within financial services, showcasing its versatility and potential for improving efficiency and decision-making.

Design of the simulated dialogues

The simulations were structured around common financial scenarios, including:

Customer Service. Responding to common inquiries about financial products, such as insurance or retirement plans.

Financial Planning. Offering tailored advice based on user preferences and financial goals.

Risk Management and Fraud Prevention. Identifying potential risks and fraudulent activities through pattern recognition.

Each scenario was designed to reflect realistic user queries and ChatGPT’s potential responses, allowing us to assess the tool’s functionality and performance across different areas of financial services.

Incorporation of case study analysis

In addition to the simulated dialogues, this study also includes real-world case studies to validate the theoretical findings. The case study analysis was used to examine how ChatGPT or similar AI technologies are being applied in actual financial institutions. These case studies serve to bridge the gap between theory and practice by providing concrete examples of ChatGPT’s impact on financial services.

For instance:

Helvetia Insurance (Switzerland) uses AI-powered chatbots to improve customer service, automate claim processing, and provide real-time support for insurance products (Zeller 2023).

Morgan Stanley has implemented AI technology to assist with personalized financial planning, helping clients manage investments through natural language processing (Son 2023).

These real-world applications demonstrate how the simulated dialogues can be applied in practical settings, offering a better understanding of ChatGPT’s potential impact on financial services.

Methodological limitations

While the simulated dialogues and case studies provide useful insights, we acknowledge the following limitations:

No Real-World Data. The simulated dialogues are based on hypothetical scenarios and do not involve actual financial data or real users. As such, they may not fully capture the complexity of real-world interactions.

Reliability and Validity. The reliability of the results depends on the quality and design of the simulated scenarios, which may not fully mirror the variety of customer interactions in real financial service contexts.

Generalizability. The findings based on these simulations and case studies may not directly translate to all financial institutions, as the success of ChatGPT’s implementation can vary across different organizations, contexts, and markets.

Future research directions

To strengthen the conclusions of this study, we suggest several directions for future research:

Empirical Case Studies. Further studies could involve detailed case studies of financial institutions that have implemented ChatGPT or other AI tools to explore their real-world impact.

Pilot Projects. Conducting pilot projects with ChatGPT in actual financial services environments would provide more reliable data and insights into its effectiveness.

Quantitative Analysis and Surveys. Incorporating quantitative data and user feedback would provide a more empirical basis for assessing ChatGPT’s impact on financial service efficiency, customer satisfaction, and decision-making.

Applications of ChatGPT in financial services: interconnection and importance

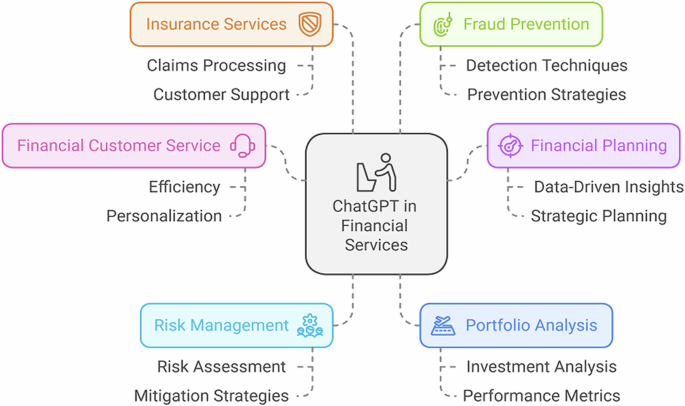

In this section, we explore the applications of ChatGPT across six key areas within the financial services sector: financial customer service, financial planning, risk management, portfolio analysis, insurance services, and fraud prevention (Fig. 1). These areas are not only representative of the core functions of financial institutions but also interconnected. By analyzing these domains, we can illustrate how ChatGPT enhances efficiency, personalization, and decision-making across the entire financial ecosystem.

The figure illustrates ChatGPT’s role in financial customer service, financial planning, risk management, portfolio analysis, insurance services, and fraud prevention.

The reason we selected these six areas is that they encompass the critical functions within financial services, each contributing to the effectiveness of financial operations. These domains are central to financial institutions’ ability to serve customers, manage risk, and optimize investment strategies. Moreover, the synergies between these areas allow for cross-domain improvements. For example, the improvements in customer service through ChatGPT provide richer data that can directly inform more tailored financial planning, while real-time risk management can also support better fraud detection and prevention.

These areas also represent key challenges and opportunities for innovation in financial services. As the financial industry continues to face increasing demands for efficiency, personalization, and security, ChatGPT offers a powerful tool to address these challenges. By exploring these six domains, we aim to demonstrate the interconnectedness of ChatGPT’s applications and their potential to enhance the entire financial ecosystem.

Financial customer service and support

Traditional intelligent customer service provides comparatively regular answers to users’ repetitive questions, which reduces the cost of communicating with human beings to some extent, but such mechanical answers often lack emotion. Nevertheless, ChatGPT, an emerging technology with robust natural language processing capabilities, thinks and expresses itself more human-likely and can answer more complex questions and give constructive responses (Deng and Lin 2022). Therefore, applying ChatGPT to intelligent customer service can improve the efficiency and quality of customer service, thereby enhancing customer experience satisfaction.

ChatGPT can provide quick and accurate responses to help answer frequently asked questions, explain products and services, and provide comprehensive support like account information (Sohail et al. 2023). By adopting ChatGPT, financial institutions can provide customers with an efficient service experience while reducing labor costs.

Besides, ChatGPT can also empower virtual digital people, which has made significant progress in terms of anthropomorphic images and intelligent dialogue (Wu et al. 2023). ChatGPT can be instrumental in multiple areas, whether in intelligent customer service, branch guidance, wealth planning, or credit review.

Swiss insurance company Helvetia is testing the use of ChatGPT to advance customer service (Zeller 2023). They claim to be the world’s first publicly traded insurance company to use ChatGPT technology for direct customer contact services. Their chatbot, Clara, uses web content from Helvetia Switzerland, which allows users to get answers about insurance, pensions, and home ownership.

We tried to simulate a user having a conversation with Chatgpt:

User: Hi, I would like to get information about financial products.

ChatGPT: Hello! We are pleased to provide you with information about financial goods. Various financial instruments, such as fixed deposits, funds, and stocks, are available from our bank. Your investing preferences and risk tolerance can be communicated to me so I can make appropriate financial product recommendations for you.

User: Although I am cautious and unwilling to take many chances, I would like to receive a certain amount of return.

ChatGPT: Our time deposits could be a good fit for you if you like low-risk investments but yet want to get a certain level of return. Time deposits are a less risky, more stable investment choice that often has a fixed interest rate. You may select the deposit duration and amount, and we will provide you with the matching interest rate and anticipated return based on your selection.

Financial planning and personalized advice

Financial planning and individualized financial counseling are available to users of ChatGPT (Awasthi 2023). ChatGPT can provide suitable financial plans by conversing with users to learn about their financial objectives, risk tolerance, and financial situation. It can offer tailored recommendations and assist users in setting a budget or planning their finances.

According to market trends and risk choices, ChatGPT can examine significant financial data to forecast and optimize individual portfolios (Ko and Lee 2024). ChatGPT may learn about the user’s investing objectives, time horizon, risk tolerance, and other aspects through conversation and will utilize this knowledge to provide customized portfolio recommendations. It aids users in optimizing their portfolios and understanding the benefits and dangers of various investing strategies.

Although ChatGPT offers specific capabilities for personal portfolio optimization and financial planning, it is not a full-fledged alternative for investment managers or professional financial advisers (Neilson 2023). The suggestions made by ChatGPT should be regarded as a guide and combined with expert judgment.

Morgan Stanley introduced ChatGPT technology to provide personalized customer service in wealth management (Son 2023). It allows for a natural conversation with clients to understand their investment preferences and financial situation, from which customized investment advice can be provided. Morgan’s intelligent language processing capabilities facilitate smoother communication between clients and theirs, improving the experience and effectiveness of wealth management services.

We tried to simulate a conversation between a user and Chatgpt:

User: I would like to have some liquidity without locking up my money for a long period of time.

ChatGPT: If you need greater liquidity, short-term financial products may be a good option. Our bank also offers short-term financial products with flexible access, such as demand deposits and short-term bond funds. Demand deposits allow you to access your money at any time, but the interest rate is relatively low. Short-term bond funds, on the other hand, can usually be liquidated within a shorter period of time and offer relatively higher returns. You can make your choice of products according to your liquidity needs and risk tolerance.

Risk management and forecasting

The application of ChatGPT in risk assessment and early warning is mainly in the following aspects:

Risk detection and early warning. ChatGPT can identify potential risk factors and abnormal transaction practices by analyzing massive amounts of data and historical transaction records and instantly send out alerts to help financial institutions take timely measures to protect the interests of their customers (George and George 2023).

Public opinion monitoring. ChatGPT can monitor expansive public opinion by tracking social media, news reports, and other public information channels (Hariri 2023). It helps financial institutions collect and analyze more information, such as market trends, consumer behavior, and competitor dynamics, which can better predict risk.

Automated credit assessment.ChatGPT can automate credit assessment, helping financial institutions more accurately determine borrowers’ repayment ability and creditworthiness (Wood et al. 2023). ChatGPT may increase assessment accuracy while lowering human error by processing massive volumes of data and producing accurate and dependable credit assessment reports.

Real-time fraud and market risk detection Financial institutions’ security and their clients’ security can be enhanced by using ChatGPT for monitoring market risk and tracking fraudulent activities. ChatGPT can assist institutions in taking prompt action to improve risk management by monitoring fraud, spotting odd account behavior, and forecasting risks (George and George 2023).

An American quantitative hedge fund company, Two Sigma, uses ChatGPT to examine financial reports and news articles to find prospective investment opportunities and hazards. Two Sigma can automate analyzing massive amounts of data and extracting valuable information from it to understand company performance and market trends better and make more informed investment decisions by utilizing ChatGPT’s natural language processing capabilities and large-scale corpus.

Let us try to mimic a user’s Chatgpt conversation:

User: Can you offer me any advice? I recently want to invest in some stocks, but I’m concerned about the huge danger of the market.

ChatGPT: Certainly! It’s critical to consider market risk while purchasing equities. It is suggested that you put the following risk management strategies into practice:

Diversification: Remain mindful of your diversification. Diversify your assets among a variety of stocks, sectors, and even asset classes to lessen the impact of individual stock risks on your total portfolio.

Understanding of the basics of business. Before choosing your stocks, learn as much as you can about the fundamentals of the company you are investing in, such as its operational environment, competitive advantages, and financial status. As a result, your investment risk is reduced, and your ability to judge the company’s potential for future growth is enhanced.

Set stop-loss levels:……

Evaluate and adjust regularly:……

Portfolio management and analysis

ChatGPT is a helpful tool for monitoring and managing an investor’s holdings. Based on the investor’s risk tolerance, objectives, and capital condition, ChatGPT may provide personalized portfolio recommendations and optimization options (Pan et al. 2023). ChatGPT communicates as an intelligent investing and trading assistant to investors and traders, providing them with market intelligence, portfolio analysis, and trading strategy development. Depending on the investor’s tastes and objectives, ChatGPT can suggest relevant investment options, whether individualized investment advice or trade execution help. Using ChatGPT as a supporting tool, investors and traders can make smarter decisions and achieve desired results in the investment arena (Dwivedi et al. 2024).

LTX, a subsidiary of Broadridge, a leading global fintech company, announced that it had built BondGPT through GPT-4, primarily used to help customers answer various bond-related questions (York 2023). LTX takes real-time bond data from Liquidity Cloud and feeds it into the GPT-4 big language model to help financial institutions and hedge funds streamline the bond investment process and provide portfolio recommendations.

Let us try to simulate a user’s conversation with Chatgpt:

User: Hi, I’ve been thinking about rebalancing my portfolio recently. Can you give me some advice?

ChatGPT: Sure! I can offer you some advice. Please let me know your current money situation, investment goals, and risk preference.

User: I currently have $100,000 to invest. My investment goal is to increase my value over the long term, and I have a certain risk tolerance.

ChatGPT: I see. Based on your situation, I can give you some suggestions. First of all, long-term appreciation is a good goal because long-term investments usually yield better returns. Depending on your risk tolerance, you might consider the following ……

Insurance services and claims processing

We can utilize ChatGPT in insurance services to deliver customers faster quoting, enrollment, and claims processing services (Biswas 2023). By engaging in a conversation with ChatGPT, customers can get help in answering their questions with promptness, as well as get recommendations on different insurance products, and it even assists them in the claims process. This technology utilizes natural language processing and machine learning algorithms to enable insurance companies to handle customer claims more efficiently. Meanwhile, ChatGPT assists insurance companies in analyzing data to identify specific causes of loss during the claims process, improving underwriting (Lo and Singh 2023).

Zurich Insurance is testing ChatGPT technology to improve claims and modeling (Ruel 2023). They hope to use the technology to extract data from claim statements and other documents to understand specific causes of loss throughout the claims process and improve underwriting. Additionally, they have created a new patent program focusing on an AI system for automated risk checking and bill processing.

We tried to simulate a user having a conversation with Chatgpt:

User: Hi, I’m looking for information about car insurance. Can you help me?

ChatGPT: Of course! Do you have any particular concerns or things you want to know about auto insurance?

User: I want to know how to buy vehicle insurance and what documentation I need to submit.

ChatGPT: Typically, the following details are needed to obtain auto insurance: information on the car and driver, insurance history, and claims history (if any). Typically, the procedure begins with selecting an insurance provider and product, filling out the application, and submitting it. Next, underwriting and quotation follow, and the final step is to pay the insurance premium to complete the purchase.

Fraud detection and prevention

According to Roy and Lohar (2023), ChatGPT can be utilized in financial institutions to identify and stop fraud. It may evaluate consumers’ transaction histories, behavioral patterns, and risk indicators to spot possible fraud and offer effective preventative measures. Through chats with clients, ChatGPT can track and examine customer behavior, assisting financial institutions in the detection and prevention of fraudulent activity as well as the protection of customer cash and personal information.

To assist financial institutions with conducting anti-money laundering and compliance monitoring, ChatGPT can automatically analyze and monitor enormous volumes of transaction data (Aggarwal et al. 2023). It can spot anomalous transaction patterns and possible security breaches, and it can act quickly to enforce compliance. It lowers the danger of money laundering activities and aids financial institutions in more effectively identifying suspicious transactions and illicit financial flows.

Let us attempt to recreate a user’s Chatgpt conversation:

User: Hello, I recently read a news report about someone having their bank account stolen, and now I’m concerned that my account may be next. What should I do?

ChatGPT: Do not stress too much; we will look at ways to protect your bank account. First, ensure that the systems and software on your computer and mobile device are current to prevent known security vulnerabilities. Additionally, be wary of links and attachments from unknown sources.

User: I appreciate your advice. I’ll take care of these security measures. Are there any other things worth noting?

ChatGPT: Of course, there are some additional security recommendations. Avoid using public Wi-Fi networks for banking, as these can be a security risk. Also, don’t give out personal information easily ……

Chatgpt case in financial services

In this section, we examine real-world applications of ChatGPT across various domains within the financial services sector. By incorporating case studies from leading financial institutions, we aim to provide empirical evidence supporting the theoretical applications discussed earlier in this paper. These case (Table 1) studies offer concrete examples of how ChatGPT and similar AI technologies are being used to improve efficiency, decision-making, and customer experience in financial services.

Financial customer service: Helvetia Insurance

Helvetia, a prominent Swiss insurance company, has implemented ChatGPT technology to enhance its customer service operations (Zeller 2023). Their chatbot, Clara, utilizes AI to provide customers with information about insurance products, pensions, and housing. By leveraging ChatGPT, Helvetia has increased response speed. It also reduced the reliance on human agents, improving overall service efficiency.

Helvetia’s case exemplifies ChatGPT in financial customer service. It supports the discussion on improving customer service quality and reducing human intervention. ChatGPT can enhance service efficiency and provide customers with a more personalized service experience.

Financial planning: Morgan Stanley wealth management

Morgan Stanley has integrated ChatGPT technology into its wealth management services. By partnering with OpenAI, the firm uses AI to facilitate natural dialogues with clients, helping them understand their investment preferences and financial goals (Son 2023). The system can provide personalized investment advice, adjusting dynamically based on market data and client preferences.

This case supports the paper’s section on ChatGPT in financial planning, especially in providing personalized financial advice and enhancing wealth management services. By using AI for personalized financial planning, Morgan Stanley has improved advisor efficiency and helped clients better understand their financial situation.

Risk management: Two Sigma quantitative hedge fund

Two Sigma, a leading quantitative hedge fund, utilizes AI to analyze financial markets and identify potential investment opportunities and risks (Xandra 2023). By employing AI technologies similar to ChatGPT, Two Sigma processes large volumes of financial reports and news articles, helping them make informed decisions in real time. The system’s ability to process data using natural language processing (NLP) and big data analytics allows Two Sigma to better assess market risks.

This case highlights the application of ChatGPT in risk management, particularly in market risk prediction and risk assessment. By leveraging AI to analyze vast amounts of data, Two Sigma can more effectively identify potential market risks and adjust its strategies accordingly.

Portfolio analysis: Broadridge’s Bondgpt

Broadridge Financial Solutions’ subsidiary, LTX, has introduced BondGPT, an AI-powered application leveraging OpenAI’s GPT-4 to enhance bond selection and portfolio management processes (Bray 2023). BondGPT is designed to simplify workflows, provide real-time insights, and support decision-making for asset managers, hedge funds, and dealers. By integrating GPT-4 with LTX Liquidity Cloud, the application delivers accurate, compliant, and timely responses to bond-related queries, aiding users in constructing optimized portfolios. BondGPT addresses challenges such as liquidity access and pricing decisions, and enhancing efficiency in portfolio management and bond trading. This innovation exemplifies how AI-driven tools can streamline portfolio analysis, reduce investment risks, and offer personalized investment insights while ensuring compliance in the financial services sector.

This case supports the section on ChatGPT in portfolio analysis, demonstrating how AI technologies like GPT-4 can optimize investment decision-making processes and enhance efficiency in portfolio construction.

Insurance services: Lemonade’s AI-powered claims system

Lemonade, an AI-driven insurance company, uses AI technology similar to ChatGPT to process client claims automatically (Jones 2023). Lemonade’s AI system quickly analyzes claims data, making real-time decisions within minutes. This has improved the efficiency of the claims process and reduced the cost of manual review.

Lemonade’s use of AI in insurance services demonstrates how ChatGPT can automate claims processing, improving operational efficiency and reducing costs. This case exemplifies the application of ChatGPT in insurance services, particularly in claims handling and customer satisfaction.

Fraud Prevention: JP Morgan’s AI-driven fraud detection system

JP Morgan Chase employs advanced AI technology to combat financial fraud by monitoring transaction behaviors in real time (Castillo 2024). The bank’s AI system analyzes large volumes of transactional data to identify suspicious activities and detect fraud before it results in significant losses. By leveraging machine learning (ML) algorithms, the system can continuously monitor for anomalies such as unusual spending patterns or unexpected transactions, which may signal fraudulent activity. If such anomalies are detected, the system triggers preventive actions to stop fraud from occurring.

This case highlights the role of AI in fraud prevention, demonstrating how JP Morgan Chase utilizes AI to analyze and detect fraud in real time. By incorporating AI into its fraud detection framework, JP Morgan significantly enhances its ability to protect clients’ financial assets and prevent fraudulent activities.

International cooperation: global implementation of ChatGPT in financial services

ChatGPT has been widely adopted not only by financial institutions in North America and Europe but also in various emerging markets. For instance, in collaboration with financial institutions in Asia and Europe, OpenAI has partnered with organizations like Helvetia Insurance in Switzerland to enhance customer service automation, and Morgan Stanley to offer personalized financial advice across global markets (Son 2023; Zeller 2023). These collaborations enable ChatGPT to function as a cross-border solution, improving market access, customer experience, and operational efficiency on a global scale.

Additionally, financial services regulators in Europe and North America have worked with AI developers, including OpenAI, to address ethical and regulatory concerns associated with AI applications in finance. For example, regulatory bodies in the European Union have discussed how to ensure ChatGPT’s compliance with GDPR and other privacy regulations when used across borders (Ladd et al. 2023).

This international cooperation exemplifies how AI models like ChatGPT can transcend geographical and organizational boundaries, demonstrating their adaptability to different regulatory environments and market conditions.

Management measurements of conversational AI applications

To ensure the successful implementation of ChatGPT in financial institutions, the adoption of conversational AI applications must be aligned with specific management measures. These measures are designed to address key challenges identified, such as ensuring data security, mitigating model bias, maintaining data integrity, and addressing regulatory compliance.

Define business requirements

Before introducing ChatGPT, financial institutions must define business requirements to ensure its deployment aligns with organizational strategies. For instance, user groups, such as retail, high-net-worth, or institutional customers, should be identified, along with functional requirements like natural language processing, intelligent recommendations, and voice interaction. These requirements are crucial for mitigating issues like model bias. By defining user needs, institutions can ensure that ChatGPT provides relevant and unbiased responses. Additionally, establishing performance metrics such as bot runtime and service level policies ensures consistent and reliable operation of ChatGPT, helping address challenges related to accuracy and trustworthiness.

Identify suitable application scenarios

The identification of appropriate application scenarios for ChatGPT is critical to maximizing its impact. It is essential to analyze user requirements and business objectives to select use cases where ChatGPT can add value. For example, in risk management, ChatGPT can process large volumes of data to assist in fraud detection or market predictions, but ensuring the quality and diversity of training data is crucial. By selecting scenarios that are aligned with business goals and supported by reliable data, institutions can mitigate risks related to data trustworthiness and ensure that ChatGPT’s predictions are based on high-quality data.

Building datasets and models

To address the challenge of model bias, financial institutions must collect diverse and representative datasets for training ChatGPT. Relevant data sources, such as customer queries, transaction logs, and market data, should be identified. Furthermore, to minimize bias, the institution should prioritize balanced datasets that represent all customer segments.

Data preprocessing should include removing irrelevant or incomplete data and standardizing formats to ensure consistency. Data anonymization and pseudonymization techniques should be applied to protect sensitive information. These actions are critical for data privacy compliance and will help institutions avoid issues related to breaches or misuse of sensitive financial data.

Feature engineering should focus on identifying key financial indicators that improve model performance, such as sentiment analysis from financial news or risk scores derived from transaction histories. Furthermore, validation and testing with separate datasets are crucial to monitor for overfitting and model bias. This regular validation process ensures that the models evolve and remain accurate over time.

Continuous improvement of the model is necessary to avoid bias and inaccuracies. Institutions should implement feedback loops to update the model based on new data and user input, ensuring that ChatGPT adapts to evolving market conditions and remains aligned with user needs.

Ensuring data security and privacy

Data security is a key challenge when deploying ChatGPT in financial institutions. To address this, organizations should implement end-to-end encryption to protect sensitive customer data during storage and transmission. This mitigates risks related to data breaches that could lead to regulatory non-compliance, legal penalties, and reputational damage.

Institutions must also establish role-based access controls to restrict access to sensitive data and deploy multi-factor authentication to enhance security. Compliance with regulations like GDPR is essential. This includes implementing procedures for handling data subject access requests and ensuring that customers’ data is not misused. Applying differential privacy techniques helps protect individual identity during data processing.

Regular security audits and real-time monitoring for breaches should be part of an institution’s proactive defense against cybersecurity threats. By conducting these measures, financial institutions can mitigate risks associated with data privacy and security breaches.

Manual intervention and regulation

Despite ChatGPT’s capabilities, human oversight is necessary to ensure the accuracy and ethical compliance of the AI’s responses. Institutions should introduce a “human-in-the-loop” system to review complex or high-stakes financial decisions. This system is particularly important for dealing with regulatory compliance and ethical concerns, especially when the AI provides responses related to investment advice, loans, or other sensitive financial topics.

Additionally, institutions should set up a regulatory framework to periodically review the AI’s operations. Regular audits of training data, model performance, and algorithmic fairness can help identify potential biases or ethical violations before they affect customer interactions or decision-making. Collaboration with regulators is key to ensuring ChatGPT aligns with legal and ethical standards.

Monitoring and evaluation

Continuous monitoring of ChatGPT’s performance is vital to ensure that its responses remain accurate and relevant to user needs. Financial institutions should set up error detection systems to identify and correct inaccuracies. This proactive approach prevents the propagation of errors that could lead to customer dissatisfaction or financial losses.

Customer satisfaction surveys and performance metrics should be analyzed regularly to gauge the effectiveness of ChatGPT. This feedback will help identify potential areas of improvement, ensuring that ChatGPT evolves in line with both customer expectations and regulatory requirements.

Establish feedback mechanisms

To further improve ChatGPT’s functionality, financial institutions should establish real-time feedback channels where customers can easily report issues or provide suggestions. These channels could be integrated into mobile apps, websites, or other customer-facing platforms. Collecting user feedback helps institutions identify pain points in ChatGPT’s responses.

Institutions should utilize the data gathered from feedback to drive data-driven improvements. Regularly updating ChatGPT’s training data based on user input can help correct biases, enhance accuracy, and refine its responses. This dynamic approach ensures that ChatGPT remains adaptable and aligned with customer needs.

While these strategies provide a structured approach to managing conversational AI, challenges remain in implementing them effectively. For instance, maintaining data quality and mitigating model bias require continuous oversight. Additionally, ensuring real-world applicability necessitates collaboration between AI developers, financial experts, and regulatory bodies. Future research should explore the long-term impacts of these strategies on financial service outcomes and develop frameworks to address ethical concerns and regulatory compliance dynamically.

Limitations and measures of ChatGPT

(1) Credibility of data sources. The data sources for ChatGPT learning are redundant and include substantial information inputted by users. Therefore, the credibility of the model needs to be verified by practice. Reliable data sources need to be established, and data preprocessing and validation must be performed to ensure the quality and reliability of input data (Ferrara 2023). Meanwhile, it should also strengthen the user feedback and monitoring mechanism to correct errors and biases in the model promptly.

(2) Cannot completely replace humans. Although ChatGPT may replace part of the financial work in certain aspects, due to the financial industry’s high requirements on information accuracy, security, and user privacy, it is difficult for ChatGPT to replace human beings altogether, and it is necessary to solve the problem of empathizing with human beings (Fui-Hoon Nah et al. 2023). ChatGPT can be used as an auxiliary tool to work with human professionals. Human professionals can provide verification and empathy to meet the financial industry’s requirements.

(3) Data privacy and security considerations. ChatGPT may involve the confidentiality of personal financial data (Lund and Wang 2023). Since ChatGPT relies on massive database information, which may contain a large amount of user-entered financial information, the risk of leakage needs to be noted. Data encryption, permission control, and data security management are required when using ChatGPT to process financial data. Institutions need to emphasize user privacy, compliant authentication, and abide by relevant laws and regulations.

(4) Model bias. ChatGPT’s training data is primarily based on publicly available data; hence, there are limitations in its ability to process specific data types. It may lead to the risk of models being biased and generating misleading content or false information (Oviedo-Trespalacios et al. 2023). Monitoring of ChatGPT training data should be enhanced to reduce the risk of bias and misleading responses. Diversity of data sources should also be introduced to minimize the impact of bias.

(5) Lack of logical and common sense reasoning. ChatGPT has some deficiencies in logical thinking, non-textual reasoning, and common sense reasoning (Borji 2023). It is especially noticeable in financial research, where a high degree of causal and analogical reasoning is required. It is possible to combine ChatGPT with the knowledge of professionals to solve complex problems. External expert systems are introduced to support logical and common-sense reasoning.

(6) Regulatory and compliance issues. Using ChatGPT in the financial sector involves regulatory and compliance issues (Alshurafat 2023). Financial institutions need to ensure compliance with data protection and consumer protection laws. Financial institutions need to concern themselves with the regulatory requirements and develop appropriate operational practices to ensure that the use of ChatGPT meets the compliance requirements.

Research agenda

In the future, we can look forward to the technical improvement and development of ChatGPT in the financial sector and explore its potential impact and breakthrough. Through conducting feasibility studies and practical recommendations, we can better facilitate the application and implementation of ChatGPT to bring innovation and progress to the financial services sector.

Going forward, the ChatGPT model has many potentials for technological improvement and model development. First, we can expect an improvement in model performance. Using larger datasets and improved training methods, ChatGPT will enable the generation of more natural and fluent language and a better understanding of semantics. Second, combining the dialogue system and ChatGPT technology allows it to perform more flexibly in conversational interactions and adjust to complex dialogue situations. Finally, as technology advances, we can expect ChatGPT to make breakthroughs in processing multimodal data covering images, text, and voice.

In the financial sector, ChatGPT also has many potential impacts and breakthroughs. It can be used as a personalized financial advisor to provide customized services by offering professional advice and investment strategies based on users’ needs. ChatGPT can be applied to automate customer service by providing fast and accurate QandA ChatGPT can also support risk management and forecasting by analyzing large-scale financial data to aid decision-making.

However, deploying ChatGPT in the financial sector in practical terms requires careful consideration of data privacy, regulatory compliance, and practical business application. Protecting user data, adhering to regulations, and understanding user needs are essential for successful implementation. Collaboration with technology companies can further drive the commercial development of ChatGPT in finance.

Conclusion

ChatGPT has widespread potential for application in financial business. By exploring its applications in financial customer service, financial planning, risk management, portfolio analysis, insurance services, and fraud prevention, we found that ChatGPT can provide financial institutions with automation solutions that enhance productivity and improve user experience. Successful deployment of ChatGPT applications requires a premium on conversational AI management. Management strategies such as clarifying business requirements, identifying application scenarios, building appropriate data models, ensuring security and privacy, conducting manual supervision, and establishing evaluation and feedback mechanisms are critical to ensuring the effectiveness and reliability of ChatGPT applications.

However, we also recognize that ChatGPT faces some imitations in the financial business. Data trustworthiness, data privacy and security issues, model bias, and regulatory and compliance issues need to be addressed appropriately to promote the development and application of ChatGPT in the financial sector.

From a theoretical perspective, the application of ChatGPT aligns with the principles of the EMH by enhancing information accessibility, reducing information asymmetry, and potentially improving market efficiency. Nevertheless, its widespread use could also introduce new challenges, such as homogenized trading strategies or increased reliance on automated decision-making. Addressing these challenges and integrating AI technologies like ChatGPT into financial markets requires careful consideration of both theoretical and practical aspects.

Looking ahead, we are optimistic about the application of ChatGPT in the financial sector as technology advances and solutions improve. We believe that upon overcoming the challenges discussed above, ChatGPT will play a more critical role in financial institutions, fostering innovation, improving efficiency, and contributing to the evolving dynamics of financial markets.

As AI technologies continue to evolve, several emerging trends are expected to shape the future of financial services. For instance, the development of multimodal AI that can process and generate text, images, and even videos offers possibilities for enhancing user interactions, such as more personalized financial advice with multimedia content. Moreover, advances in quantum computing could boost AI’s computational capabilities, enabling faster financial predictions, risk assessments, and market analysis. At the same time, the growing focus on AI ethics will compel financial institutions to integrate transparency into their AI models, ensuring decisions made by AI systems are explainable. These emerging trends will enhance the capabilities of AI in financial services.

Responses