Sovereign bond yield and cryptocurrency returns within the frontier West African monetary zone: a dynamic contagion analysis

Introduction

The emergence of global financial innovations, notably blockchain technology, has led researchers to re-evaluate the nature of contagion between financial markets and different asset classes worldwide. The catastrophic effect of the COVID-19 outbreak in 2019 on the world financial outlook has further intensified discussions regarding the financialization of these asset classes (Armah et al., 2022; Bouri et al., 2021). In our review of these financial innovation studies during the COVID-19 pandemic, we identified three distinct strands of the literature. Strand one offers significant links between volatility transmission among different asset classes and cryptocurrencies (Rubbaniy, Khalid et al., 2021; Corbet et al., 2019). Strand two investigates the function of cryptocurrencies as hedging tools, as diversification assets, or as safe-haven instruments among themselves and other asset classes (Bouri et al., 2021; Gurdgiev & O’Loughlin, 2020; Le Tran & Leirvik, 2020). Kuffour et al. (2021) and Katsiampa (2019) provided valuable insights into vital investigations that analyze interlinkages, integrity, dynamic changes over time, and the fundamental factors underlying cryptocurrencies in strand three. Together, these strands of research provide a comprehensive view of how cryptocurrencies interact with sovereign bond yields and their broader impact on the financial ecosystem amid global economic challenges. This understanding is crucial for improving risk management, investment strategies, and policy-making in the rapidly evolving financial markets during the pandemic.

However, their interconnectedness is limited in relation to frontier countries within the West African monetary zone (WAMZ). Driven by these gaps, which include omitted volatility spillover and hedging potential among cryptocurrencies and WAMZ bonds yields, respectively, during the COVID-19 pandemic and the Russia–Ukraine war, there is an increased opportunity to introduce a divergent view into these debates. This paper, therefore, investigates the dynamic relationships between sovereign bond yields and cryptocurrency returns within the frontier West African monetary zone. The contagion effects between these two financial markets are scrutinized, taking into account the distinct economic conditions of the sub-region. Using the dynamic contagion model, we explore how shocks in one market may spillover and influence the other, with a focus on understanding the potential for contagion between sovereign bond markets and cryptocurrency returns. Specifically, we examine the contagion between cryptocurrency returns and sovereign bond yields in the frontier economies of the West African Monetary Zone, taking into account the unique macroeconomic challenges these countries faced, which were intensified during the COVID-19 pandemic, including (1) Weak Institutions: Many WAMZ countries have institutions with limited capacity to enforce laws and regulations effectively, affecting their financial stability and market functioning. (2) Weak Currency: The national currencies in these economies often face depreciation pressures, which can affect the performance and stability of both sovereign bonds and cryptocurrencies. (3) Perceived Corruption: High levels of perceived corruption can undermine investor confidence and distort market dynamics, affecting how contagion between asset classes manifests. (4) Market Inefficiencies: These economies often have less developed financial markets with inefficiencies that can exacerbate volatility and contagion effects. (5) Unsustainable Debt Levels: High levels of public debt in these countries can lead to increased financial instability and influence the behavior of sovereign bond yields and cryptocurrency markets. These challenges are unique to WAMZ economies, which means that findings from studies conducted (Tsang et al., 2021; Havidz, Rahmadani & Tori, 2023) in other economic regions may not accurately reflect the conditions in these countries. This underscores the importance of setting the study within the specific context of WAMZ. By examining these factors, we aim to understand how crises affect the relationship between cryptocurrency returns and sovereign bond yields within WAMZ, providing insights into how these markets interact under the strain of significant economic challenges.

Sovereign bond yields are key indicators of economic health, reflecting government borrowing costs and investor confidence. They are integral to the global financial system and used to assess financial stability. Studying the contagion effects between sovereign bond yields and cryptocurrencies can reveal how changes in bond yields impact or are impacted by cryptocurrency returns, providing insights into financial stability and risk. In WAMZ economies, where sovereign debt and currency stability are major concerns, global financial shocks can significantly affect bond yields. Cryptocurrencies, with their volatility, may interact with these indicators in unique ways, offering valuable insights for investors and policymakers. The focus on sovereign bond yields and cryptocurrency returns provides a reliable benchmark for understanding financial contagion and its broader implications.

Previous studies (Diallo et al., 2021; Asafo-Adjei et al., 2021; Frimpong et al., 2021) suggest that information spillovers during turbulent trading periods lead to diverse responses among market participants based on investment horizons. Other scholars (Le Tran & Leirvik, 2020; Gurdgiev & O’Loughlin, 2020; Bouri et al., 2021) have posited the role of cryptocurrency as a hedger with other asset classes. However, these studies did not specifically examine the WAMZ frontier economies as a case and had limited observations regarding intracountry contagion analysis. This research aims to address these gaps and focuses on two key aspects: (1) to explore the level of contagion among sovereign frontier markets and (2) to investigate the extent of volatility spillover on market integration during the COVID-19 pandemic. To achieve these objectives, we analyze daily data spanning 01/26/2021 to 10/07/2022. The research again examines lead-lag relationships and investigates how different frequencies influence the correlation between cryptocurrencies returns and WAMZ sovereign bonds yield.

This paper contributes to the existing literature concerning the impact of COVID-19 and Russia–Ukraine war on global financial markets in diverse ways. Firstly, on the theoretical front, our study incorporates the adaptive, competitive, and heterogeneous market hypotheses proposed by Lo (2004), Fama (1970), and Müller et al. (1997), respectively. We firmly believe that exploring these theories has the potential to enhance our understanding of market dynamics and investor behavior, especially during turbulent times. By delving into these theories, we gain valuable insights into how markets adapt, compete, and demonstrate diverse characteristics, providing valuable perspectives on the complexities of financial ecosystems during challenging periods. Secondly, the results of the study offer an innovative empirical approach to investigating interdependence and contagion. The analysis of time-varying shape shifts in interdependence and contagion complements previous studies on tail-dependence and interdependence, thereby completing the puzzle of return distribution dependence. Examining contagion in this context provides new evidence for understanding spillovers within frontier bond yields and between cryptocurrency returns, offering deeper insights into the interdependence and contagion of these two asset classes. The shape of returns encapsulates essential market dynamics over time, which might otherwise go unnoticed. Consequently, analyzing the shape distribution parameters yields valuable information for all market participants. Thirdly, our study shares similarities with that of Jnr et al. (2021). However, their work focused on the bidirectional movement between cryptocurrency returns and volatility during COVID-19, and the conditional relationship between cryptocurrencies and WAMZ bonds was absolutely ignored. The use of bivariate and multiple wavelet techniques reveals the specific dynamics between frontier bond markets and cryptocurrency markets. While multiple wavelet correlations provide a single indication of a leading variable at a given scale, this limitation is addressed by bivariate wavelets, which offer multiple indicators of leading and lagging variables across different scales throughout the sample period while accounting for specific conditions. The outcome of this analysis is a fine-tuned relationship between two markets, which can be replicated with minimal discrepancies. Lastly, this study not only provides valuable investment insights but also prompts policy responses aimed at safeguarding the sovereign bond market from the impacts of cryptocurrency investments and potential contagion effects.

Our findings suggest that while there is a limited direct correlation between these markets, significant spillover effects occur during periods of high market volatility. These results have important implications for investors and policymakers in the region, particularly in terms of portfolio diversification and financial stability. Ultimately, this paper provides new insights into the interconnectedness of global financial markets and the emerging role of cryptocurrencies in frontier economies, prompting the need for timely and frequency-based policy decisions to achieve the desired outcomes.

The introduction is followed by the “Theoretical foundations” in section two, the “Literature” in section three, the “Methodology” in section four, the “Data and analysis” in section five, and the “Results and discussion” in chapter six. The paper concludes with “Policy implications” in section seven.

Theoretical foundations

The study of market hypotheses is dynamic and ongoing, with researchers continuously refining existing theories and developing new ones to better comprehend the intricate workings of financial markets and the behavior of investors. As new data become available and technology advances, our understanding of these phenomena deepens, leading to further insights and potential revisions to existing frameworks. The key theories that are relevant in relation to the study are explained below.

The adaptive market hypothesis (AMH) posits that financial markets eliminate inefficiencies through arbitrage, which is driven by learning, competition, and evolutionary pressures, in contrast to the traditional efficient market hypothesis (EMH). It views individual agents as boundedly rational rather than hyper-rational. This study leverages the Adaptive Market Hypothesis (AMH) to explore how arbitrage opportunities in the frontier West African monetary zone’s sovereign bond and cryptocurrency markets evolve over time. AMH predicts that, although inefficiencies initially arise, they are gradually eliminated as agents learn and adapt to market conditions. In line with this, the study tracks the profitability opportunities of bond and cryptocurrency returns and finds that as certain strategies become less effective, new, more complex strategies emerge, consistent with the principles outlined by Lo (2004).

The efficient market hypothesis (EMH) posits that a market is “perfectly efficient” when prices consistently reflect all available information. According to the EMH, all relevant financial market information is promptly incorporated into security prices. While new information may cause temporary market imperfections, these imperfections are quickly corrected through arbitrage.

Early empirical tests by Fama (1970) supported the EMH, categorizing the tests into three levels: weak, semi-strong, and strong. This classification helps evaluate the hypothesis based on varying levels of information. This study however, tests the Efficient Market Hypothesis (EMH) by examining whether new information about sovereign bond and cryptocurrency market/asset is fully reflected in asset prices, consistent with Fama’s (1970) classification of information efficiency. Our findings indicate that while short-term price movements do reflect new information, certain longer-term inefficiencies persist, suggesting that the market may not be as efficient as EMH predicts.

The heterogeneous market hypothesis (HMH) posits that market agents vary in their perceptions, risk profiles, institutional constraints, levels of information, prior beliefs, and geographical locations (Müller et al., 1997). This diversity allows traders to switch strategies based on changing preferences and investment needs, leading to different forms of volatility. The HMH suggests that asset prices may not always fully reflect available information, causing periods of inefficiency where prices deviate from fundamental values. This highlights the importance of considering investor heterogeneity and psychological factors in financial modeling and analysis for a more accurate understanding of market behavior and investor decision-making.

Connecting theory to research

The central question of this paper is how well the principles of AMH and EMH can explain observed phenomena in modern financial markets. To this end, the study aims to evaluate whether market inefficiencies persist over time and, if so, how these inefficiencies evolve in response to changing conditions. The AMH suggests that inefficiencies may not be fully eliminated and that complex, adaptive strategies may remain profitable for extended periods, providing a contrast to the more static view of market efficiency proposed by EMH.

The findings of this study are expected to contribute to the ongoing debate between EMH and AMH by providing empirical evidence on how market agents adapt, learn, and exploit inefficiencies. By examining the persistence of inefficiencies across different time periods and market conditions, the paper will test the hypothesis that market strategies evolve over time, in line with the AMH, or if markets demonstrate a greater degree of efficiency as predicted by the EMH.

Moreover, this paper will also investigate how the heterogeneous market hypothesis (HMH), which emphasizes the role of diverse agents with different strategies and information, complements the AMH in explaining observed market behaviors. Specifically, we hypothesize that the heterogeneity of market participants can contribute to the persistence of inefficiencies by allowing for multiple adaptive strategies to coexist and compete within the market.

Theoretical implications

By integrating AMH, EMH, and HMH, this study aims to offer a more nuanced understanding of market dynamics that accommodates both rational and adaptive behavior. The EMH serves as the baseline for understanding market efficiency, while the AMH provides an evolutionary perspective on how markets adapt over time. The HMH adds an additional layer by considering the diversity of market participants and their differing strategies. Together, these hypotheses form the framework for analyzing the research questions and interpreting the findings in this paper.

Review of the literature

A surge in empirical research on financial markets ensued in the wake of the COVID-19 pandemic. This global crisis has unleashed a systemic upheaval, marked by escalated global risk aversion, resulting in a financial imbalance across the global economy. This subsection reviews various works by authors in relation to interdependence and contagion.

Interdependence and contagion

The term “interdependence” refers to the mutual reliance or connection between different countries, industries, markets, or economic agents. It highlights how the economic actions or conditions of one entity or nation can affect or be affected by the actions and conditions of others.

The term “contagion” on the other hand, refers to the spread of economic or financial shocks from one market, country, or region to others, often causing widespread instability or crises. It is typically used to describe the way negative events such as a financial crisis, economic downturn, or market crash can propagate rapidly across different countries or sectors, even if those regions or markets were not initially involved in the event. (See Bekaert, Ehrmann, Fratzscher & Mehl, 2014) inspect contagion to 415 country-industry equity portfolios with a factor model. They find that the US and the global financial sector are the transmitters of small contagion effects but that considerable transmission from domestic markets to individual domestic portfolios is tampered with by the quality of the respective domestic factors.

For many decades, the literature on interdependence and contagion among market economies has focused on comovements and what has become known as “synchronization in both stock markets and macroeconomic variables”. Abate & Servén (2018) note that global equity return comovements are perceived as replicating inescapable common shocks or local linkages between countries.

A previous study posited that global financial integration does not significantly affect output synchronization across countries (Pappas et al., 2016). Currently, studies on interdependence and contagion should not be limited to the effects of a single crisis, such as the global financial crisis (GFC). In an impact and response study of the Eurozone crisis, Mollah, Quoreshi, & Zafirov (2016) examine the contagion spread from the US to both emerging and frontier market economies, focusing on dollar-denominated equity market indices from 2003 to 2013. Their research investigates how the crisis influenced these markets and the extent to which it affected global financial stability. Their analysis revealed that dollar-denominated equity market indices were notably impacted, with increased volatility and spillover effects observed across various markets. The study highlighted how the crisis not only affected the financial stability of developed economies but also had substantial repercussions for other markets. This contagion underlined the interconnectedness of global financial markets and the far-reaching impacts of economic crises.

Studies of interdependence and contagion in a large volume of literature have been strongly linked with periods of financial crisis. For instance, from the Asian financial crisis to the European debt crisis spanning 2010 to 2013, Fry-McKibbin et al. (2014), via a regime-switching model, delineated nine different crisis episodes and juxtaposed them against contagion transmission hypotheses. They analyze the interconnectedness of equity markets through the lens of correlation, coskewness, and covolatility. Their findings claim that emerging market crises spread sporadically, especially to developed market economies, as trade linkages are less likely to be the source of crisis transmission than finance ties. Despite the wide scope of this study, the authors’ variables for contagion tests—correlation, coskewness, and covolatility—are only skewness and volatility estimated from returns across different periods without accounting for the asymmetric nature of the distribution generating these measures. Without addressing this issue but rather for robustness, the authors performed joint tests of contagion by simultaneously considering coskewness, cokurtosis, and covolatility. Nonetheless, this test was only applied to Eurozone equity returns from 2005 to 2014, limiting the range of EMs captured by Fry-McKibbin et al. (2018).

Furthermore, the US subprime crisis as the originator of contagion spreading across markets was evident. For instance, Dungey & Gajurel (2014) discover a larger portion of contagion from the US in aggregate equity market indices than in financial sector indices for financial markets. Additionally, a study found even more contagion for most financial markets during crisis periods; the study used foreign exchange market indices (Celık, 2012).

A large strand of financial market studies has investigated the interdependence and contagion between emerging stock markets and global stock markets. For example, with emerging stock markets (Brazil China, Russia, and Turkey) vis-à-vis the UK, the US, and Germany from January 2001 through December 2014 at monthly periodicity, Al Nasser & Hajilee (2016) examine both short- and long-run relationships among these markets. Their results confirm stock market integration for both time horizons, albeit to varying degrees.

Despite the widespread impact of crises on stock markets, the authors did not clarify how these effects influenced their estimates and recommendations for the studied period. There has been a gradual shift in paradigm regarding the methodological approach to the study of interdependence and contagion in the literature. However, countless works have employed econometric models based on either the frequency or time domain of different versions of correlations. For example, in a supposedly advanced unifying approach to identifying contagion in 25 stock markets, Sewraj et al. (2018) specify a time-indexed parametric model shying away from the frequency metadata of the return series.

Similarly, in a multiscale correlation style, Wang, Xie, Lin, & Stanley (2017) identify stock market contagion during the global financial crisis at different time scales of the return series. To analyze sectoral dynamics of financial contagion in Europe, Alexakis & Pappas (2018) employ the asymmetric dynamic conditional correlation generalized autoregressive conditional heteroscedasticity (GARCH) model. Introduced by Engle & Sheppard (2001), the dynamic conditional correlation assumes conditional time-varying correlations and variances without frequency footprints. Researchers often elect to use dynamic conditional correlation over time-scale models, citing complexity in interpretation in the latter models.

However, an increasing number of studies have made use of frequency-time (time-scale) domain techniques such as wavelets and Cospectral technology for several years. Aloui & Hkiri (2014) contend the use of different models other than those simultaneously allowing for comovement assessment at both frequency and time levels, and they mostly produce conflicting results.

The wavelet methodology introduced by Grossmann & Morlet (1984) has the desirable property of time-scale decomposition of return series, which is lacking in other techniques. It has thus been applied in recent years for interdependence and contagion studies. For instance, with wavelet analysis, Ftiti, Tiwari, Belanès, and Guesmi (2015) tested financial market contagion for OECD countries. Likewise, with a multi-time wavelet analysis. The study reveals both long-run and short-run comovements, highlighting interdependence and contagion across markets, with some differences between them. The findings offer valuable insights for investors, helping them tailor investment strategies based on countries’ sensitivity to permanent and temporary shocks. Policymakers can also use the results to develop effective crisis management strategies.

Dewandaru, Masih, & Masih (2017) investigated regional spillovers across the emerging and frontier financial markets of Saudi Arabia, the UAE, South Africa, and Israel. In the link between oil and the exchange rate in major emerging markets, Živkov, Njegić, & Balaban (2018) also employ multiscale wavelet analysis. The concerns for complexity in fitting and interpretation for which some authors abstract away from the use of the wavelet technique are adequately eased with the wavelet cross-correlation and wavelet multiple cross-correlation introduced by Fernández-Macho (2018). This approach can handle multiple variables, unlike traditional pairwise comovement analysis in the wavelet framework. Despite its ability to examine interdependence and contagion in the complete state space, neither the bivariate nor multivariate wavelet approach involves the distributional properties of return series in the technique.

Amid the emergence of multiple instances of extreme market conditions precipitating crises across various markets, there has been a notable uptick in studies examining comovements in these occurrences. These extreme market conditions often manifest in the distributional attributes of returns, commonly known as tail events. Such tail events have substantial implications for risk management and portfolio diversification strategies. In light of events such as the Global Financial Crisis (GFC), the Asian Financial Crisis (AFC), and other similar crises, the current literature is experiencing a surge in research aimed at elucidating potential contagion effects across markets while also accounting for dependencies during extreme tail events. For instance, Boubaker, Raza (2017) investigate the dynamic dependence together with asymmetric tail comovement of the US with CEE equity markets via a time-variant copula. They find that significant indications of comovement display large time variations and asymmetry in the tails. Similarly, Mensah & Alagidede (2017) studied emerging African market relations with DMs and discovered that except for South Africa, other African FEMEs do not suffer risk spillover effects from DMEs. They also find tail-dependence suggestive of alternating comovements between rising and plummeting market cycles. The strength of the novel copula technique as a measure of tail behavior is its ability to model the marginal distributions of returns. However, copulas provide a single parametric measure of the tail of returns. They thus fall short in providing a comprehensive distribution of returns.

Other approaches to studying interdependence and contagion using Value-at-Risk (VAR) as a measure of tail risk have also been used in the context of tail-dependence in the literature. For example, Mensi, Hkiri, Al-Yahyaee, & Kang (2018) employ a VAR-based wavelet approach to investigate the comovement between the BRICS stock markets and commodity prices. They document strong comovement between BRICS stock indices and crude oil prices during the GFC but zero comovement with gold. Again, between the US and leading Asian stock markets, Shen (2018) finds evidence of significantly increasing VAR in the Asian markets, save China and Russia, resulting from shocks from the US. They obtain these tail interdependency patterns from the multivariate quantile regression model of the VAR for the VAR. Like the copula, the VAR is an incomplete asymmetric “distribution-capturing” model.

The field of finance and economic studies has shifted focus to nontraditional market spillovers, particularly highlighting the rise of cryptocurrencies as a new class of financial assets. Unlike traditional currencies and investment instruments, cryptocurrencies operate outside the conventional banking system and financial regulations. However, their increasing adoption and integration into the global economy are introducing new dynamics of interdependence and contagion, affecting global markets in ways that traditional assets have not. Cryptocurrencies are transforming economic interdependence and contagion through their decentralization, volatility, and global reach. These unique features create new connections between markets and financial systems, while also introducing risks of systemic contagion. As cryptocurrencies gain prominence, understanding their impact on interdependence and contagion will be crucial for policymakers, investors, and financial institutions. Given its significance, numerous studies have explored cryptocurrencies from various perspectives, particularly focusing on their role in diversification and hedging. For example, Bouri et al. (2021) examined the hedging and safe-haven properties of eight cryptocurrencies in relation to downturns in the S&P 500 and its 10 equity sectors. Using the cross-quantilogram method, the research finds that Bitcoin, Ripple, and Stellar act as safe havens for all US equity indices, while Litecoin and Monero serve as safe havens for the overall index and specific sectors. Ethereum, Dash, and Nem are identified as hedges for only a few sectors. The results offer insights for investors seeking to mitigate equity losses by incorporating cryptocurrencies into their portfolios. Shahzad et al. (2019 and 2020) investigate the volatility and interdependencies between cryptocurrencies like Bitcoin and Ethereum and traditional financial markets, focusing on their roles in diversification, hedging, and interactions with assets such as stocks, commodities, and currencies. Their study highlights that while cryptocurrencies provide diversification benefits due to their low correlation with traditional assets, their high volatility and speculative nature limit their effectiveness as hedging instruments, making them potentially useful in times of financial stress but risky for investors seeking stable returns. Urquhart and Zhang (2019) examine Bitcoin’s potential as a safe-haven asset during market stress, finding that while Bitcoin can provide diversification and risk-reduction benefits in times of financial instability, its high volatility and speculative nature limit its reliability as a stable safe-haven, making it risky for investors seeking consistent returns or risk management. Kliber et al. (2019) analyze the role of cryptocurrencies as financial assets, highlighting their potential for investment, diversification, and hedging, despite their high volatility. While cryptocurrencies offer diversification benefits due to their low correlation with traditional assets, their speculative nature and regulatory uncertainties make them risky and less reliable as long-term hedging instruments. Selmi et al. (2018) did a study that compares the roles of Bitcoin and gold as hedges, safe havens, and diversifiers against extreme oil price movements, using a quantile-on-quantile regression approach to account for different market and oil price conditions. The findings show that both assets serve these roles effectively, with their performance being sensitive to market conditions and oil price regimes, while also offering diversification and risk-reduction benefits in oil portfolios, especially during times of political and economic uncertainty.

Weak linkages have been documented by previous studies regarding Cryptocurrencies and major financial instrument contagion. Dehrberg, 2016 examines the half-life volatility of three cryptocurrencies (Bitcoin, Litecoin, and Ripple) using two GARCH models (PGARCH(1,1) and GARCH(1,1)) with a student-t distribution. The results show that PGARCH(1,1) is the most appropriate model, with the half-life of volatility being 3 days for Bitcoin, 6 days for Litecoin, and 4 days for Ripple, indicating that all three cryptocurrencies exhibit strong mean reversion and relatively short volatility cycles. Finally, Panagiotidis et al. (2019) paper reviews the literature on the effects of various factors (stock market returns, exchange rates, gold and oil prices, central bank rates, and internet trends) on Bitcoin returns. Using alternative VAR and FAVAR models, the study finds significant interaction between Bitcoin and traditional stock markets, a weaker connection with foreign exchange markets and the broader macroeconomy, and limited influence of popularity measures; it also highlights a growing but recently diminished impact of Asian markets, particularly due to Chinese regulatory actions and the decline of the CNY’s share in Bitcoin trading.

Contagion and causality analysis of cryptocurrency’s non-dependence from other major financial market instruments was performed. Li et al. (2023) in their paper examine the dynamic time-frequency volatility spillover effects between Bitcoin and Chinese financial markets, focusing on major events. The findings show that Bitcoin is the net risk receiver in these spillovers, which are asymmetric, with total spillovers peaking before the 2015 China stock crash, increasing during the 2018 US-China trade disputes, and reaching a peak during the COVID-19 pandemic. These spillovers primarily affect stock, foreign exchange, and copper futures markets, especially at medium and low frequencies, highlighting the need for investors and regulators to assess Bitcoin’s risks based on time and frequency perspectives. Handika et al. (2019) investigate cryptocurrency contagion in Asian financial markets using three methods: bias-adjusted correlation coefficients, multinomial logistic regression for extreme returns, and a vector autoregression (VAR) system. The findings reveal that cryptocurrencies show a low correlation with Asian stock and foreign exchange markets, both in high and low variance periods and after adjusting for biases, no significant contagion effects were observed. Further analysis using multinomial logit and VAR models confirmed that cryptocurrencies do not significantly influence or explain changes in Asian financial markets, suggesting that they do not pose a systemic risk to the region.

The sensitivity of the cryptocurrency industry to political risk and regulation is relatively high. The spillover effect of both elements on cryptocurrency prices internationally cannot be undermined (Aysan et al. (2019) in their paper examines the predictive power of the global geopolitical risks (GPR) index on the daily returns and price volatility of Bitcoin from July 2010 to May 2018, using the Bayesian Graphical Structural Vector Autoregressive (BSGVAR) technique). The study finds that GPR positively impacts Bitcoin’s price volatility and negatively affects its returns, with stronger effects at higher quantiles, suggesting that Bitcoin can serve as a hedging tool against global geopolitical risks.

Cryptocurrency’s regulatory efficiency is reflected in terms of anti-money laundering, exchange issuance, and information regarding state-guaranteed digital currency. For example, Bouri et al. (2017) posit that cryptocurrency recoils affirmatively to uncertainties at the top quantiles for short-term investments. This result was derived when he studied cryptocurrency using quantile regression analysis.

Incorporating cryptocurrencies into the discussion of modern finance provides a more comprehensive understanding of their evolving role in global markets. As cryptocurrencies continue to grow in prominence, they not only foster economic interdependence across borders but also introduce new dynamics that could potentially contribute to financial contagion, making their impact on global markets an increasingly critical area for study.

Methodology

Theoretical model development

This theoretical model aims to explore the dynamic relationship between sovereign bond yields and cryptocurrency returns within the frontier West African monetary zone. Given the increasing integration of global financial markets and the rise of cryptocurrencies, understanding these interactions is crucial for effective financial management and policy formulation in the region. The model comprises three main components: Sovereign Bond Yields (({{RB}}_{,t})): Representing the cost of government borrowing and investor perceptions of credit risk. Cryptocurrency Returns (({{RC}}_{,t})): Reflecting the performance and market sentiment surrounding cryptocurrencies and Contagion Mechanism (({{Contagion}}_{,t})): The transmission mechanism through which changes in one market affect the other over time

-

1.

Sovereign Bond Yields:

$${{RB}}_{,t}={rm{alpha }}{rm{B}}+{{rm{beta }}}_{B}{R}_{B,t-1}+{{rm{gamma }}}_{B}{R}_{c,t-1}+{{rm{delta }}}_{B}{S}_{t-1}+{epsilon ,}_{{Bt}}$$(1)({rm{alpha }}{rm{B}}): Constant term, ({{rm{beta }}}_{B}{R}_{B,t-1}): Coefficient for the lagged return on the bond market, ({{rm{gamma }}}_{B}{R}_{c,t-1}) Coefficient for the lagged return on the cryptocurrency market, ({{rm{delta }}}_{B}{S}_{t-1}): Coefficient for market sentiment and ({epsilon ,}_{{Bt}}): Bond market shock.

-

2.

Cryptocurrency Market Return Dynamics (({{RC}}_{,t})):

$${{RC}}_{,t}={rm{alpha }}{rm{C}}+{{rm{beta }}}_{C}{R,}_{t-1}+{{rm{gamma }}}_{C}{R}_{B,t-1}+{{rm{delta }}}_{C}{S}_{t-1}+{epsilon ,}_{{Ct}}$$(2)αC: Constant term, ({{rm{beta }}}_{C}{R,}_{t-1}): Coefficient for the lagged return on the cryptocurrency market. ({{rm{gamma }}}_{C}{R}_{B,t-1}): Coefficient for the lagged return on the bond market, ({{rm{delta }}}_{C}{S}_{t-1}) : Coefficient for market sentiment, ({epsilon ,}_{{Ct}}): Cryptocurrency market shock.

-

3.

Contagion Mechanism:

({{rm{theta }}}_{Bto {rm{C}}}): Contagion effect from bond market shocks to the cryptocurrency market and ({{rm{theta }}}_{Cto {rm{B}}}) Contagion effect from cryptocurrency market shocks to the bond market.

This theoretical model provides a comprehensive framework for analyzing the dynamic interactions between sovereign bond yields and cryptocurrency returns in the frontier West African monetary zone. By incorporating dynamic contagion analysis, the model offers valuable insights for managing financial risks, developing investment strategies, and formulating effective policies in the region.

Estimation technique

In this stage, we extract the time-series data of shape parameters from the best-fitting distribution. We then analyze this time-series data for interdependence and contagion within the time-frequency domain. Time-frequency domain models have become increasingly popular because they allow for time-scale decomposition, enabling simultaneous analysis of varying relationships between multiple series. While Fourier transforms are simpler and more computationally efficient, wavelet analysis offers greater flexibility and power for analyzing complex, non-stationary signals. Wavelet analysis excels in capturing both time and frequency information, adapting to different signal characteristics, and providing multiresolution analysis, making it a preferred choice over the Fourier transforms in this study.

Advanced models like Markov switching, nonlinear ARDL, and copulas have been used by numerous authors (Bouteska, Sharif, & Abedin, 2023; Nusair, Olson 2021; Dewick & Liu, 2022). However, these advanced models still do not fully address nonlinearity and structural breaks in time-series data. To tackle these limitations, wavelet methodology has been adopted for this study. Wavelets are effective in detecting market linkages without distorting the data, offering a significant advantage over traditional econometric models. Both bivariate and multivariate approaches within the wavelet framework were utilized. Bivariate analysis and wavelet multiple correlation (WMC) were specifically included. This approach aims to uncover the complete dynamics of volatility within the framework of the heterogeneous market hypothesis.

Pertinent studies that have used the wavelet methodology include those of Andrieş, Ihnatov, & Tiwari (2016), Boako, Alagidede et al. (2016), Fernandez-Macho (2018), and Kumar, Pathak, Tiwari, & Yoon (2017).

Bivariate wavelet-based measure of Interdependence and contagion

The Morlet wavelet is considered the most suitable technique for analyzing phase interactions and has proven valuable for economic implications analysis (Ftiti et al., 2015).

Equation 4 defines the Morlet wavelet, where ω represents a non-dimensional “time” variable.

where, (omega) is a non-dimensional “time” parameter.

Equation 5 represents the ‘wavelet coherence’ between ‘two’ ‘time’ ‘series’ xt and yt. where S is a smoothing operator.

Equation 6 illustrates the ‘wavelet phase’, revealing potential lead or lag relationships ‘between two-time-series’

If the absolute value of ({theta }_{{xy}}) is less/larger than π/2, it indicates that the two series move in phase (or anti-phase, if larger), with the instantaneous time as the time origin and at the frequency under consideration. The sign of the phase indicates which series is the leading one in the relationship.

Multivariate wavelet-based measure of interdependence and contagion

The resulting lead-lag relationships for multiple variables are best fit for the wavelet multiple correlation and cross-correlation.

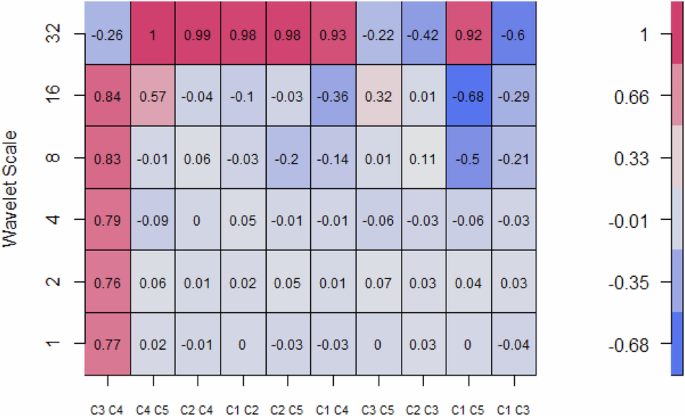

Equation 7 defines the multiple correlation wavelet.

At each scale λj, the multiple wavelet forms a regression of a linear combination w1jt, where i = 1, 2…, n variables.

Equation 8 represents the correlation matrix of the diagonal variables

Wij is chosen to maximize (Phi)({rm{Y}}) (λ), and wijt represents the regression ‘fitted values’ of wij on the endure wavelet coefficients at scale λj.In Eq. 9, ɍ represents the lagged difference between the observed and fitted values of the variables selected as the criterion variable at scale λj.

The confidence intervals of wavelet multiple correlations are obtained using Fisher’s (1915) transformation.

The authors managed parameter sensitivity in wavelet analysis by carefully selecting the appropriate wavelet based on data characteristics and comparing different types. They experimented with various decomposition levels to balance detail and efficiency. They also systematically varied parameters and assessed their impact to ensure stability and reliability. Additionally, they used cross-validation and robustness testing to confirm that their conclusions were consistent and accurate. These methods ensured the wavelet analysis yielded reliable results.

Data and analysis

To investigate the return distribution of frontier markets and examine the time-varying shape of interdependence and contagion for frontier bond yields and cryptocurrency returns, the selected data and their sources are fundamental for the results; therefore, it was imperative that the study observes numerous databases and sets available. In line with previous studies (Bouri et al., 2017; Corbet et al., 2018; Cheah & Fry, 2015; Nguyen et al., 2021), this study utilizes diurnal (daily) price data for the three major cryptocurrencies Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), alongside frontier WAMZ bonds from Ghana and Nigeria.

We analyze daily data spanning 01/26/2021 to 10/07/2022, with a total observable value of 444 after scouring unqualified data due to missing variables during the COVID-19 pandemic, covering six major waves (Jareno et al., 2023). The period from January 26, 2021, to July 10, 2022, was selected for analyzing the impact of COVID-19 on sovereign bond and cryptocurrency markets due to several key events and trends. This time-frame encompasses the post-vaccine economic recovery phase, marked by mass vaccine rollouts and the reopening of economies, which influenced both markets. Sovereign bonds were impacted by inflation concerns, fiscal stimulus, and central bank policies, while cryptocurrencies saw increased institutional adoption and significant volatility, with rising interest in cryptocurrency as a potential hedge against inflation. Additionally, the emergence of new COVID-19 variants, geopolitical tensions (e.g., the Russia–Ukraine conflict), and the exploration of central bank digital currencies (CBDCs) shaped market dynamics. This period also provides a stable data set, free from the extreme disruptions of the early pandemic or later post-pandemic shifts, allowing for clearer insights into the long-term effects of the pandemic and the evolving global financial landscape.

Data availability is also a key component of the scope understudied, therefore, a data availability analysis was conducted, and with positive outcomes, the time-frame selection of these cryptocurrencies was chosen accordingly. Datasets were chosen from the FTSE sovereign bond indices Kraken, a centralized database for cryptocurrency trade, and this was in line with what was posited by Alexander & Dakos (2020). Note also that bonds were taken from the DataStream database. This study aimed for high-frequency data; therefore, crypto spot prices and the bond bid–ask spread were used because of their excessive exchanges and extended trading globally Baur & Dimpfl (2019). Furthermore, daily trading features allow for the use of daily data. The use of daily data is important because we are able to assess the stated objectives at the macro price level. High-frequency trading market macrostructures feed into the price-generating process (O’hara, 2015; Stoikov, 2018; Zook & Grote, 2017).

Studies that have used daily data in this regard include Charupat & Miu (2011) and Meziani & Meziani (2016). With the tremendous rise of automated high-frequency trading in the past 20 years and accounting for almost half of all trading activities worldwide, the use of daily data in financial econometric modeling has only risen at a similar pace (Zook & Grote, 2017). Hautsch, Kyj, & Malec (2015) specifically address the merit of high-frequency (HF) data in portfolio allocation. They discuss the effectiveness and relevance of HF data in this regard and offer evidence that can be used with proper econometric models. More importantly, they argue that these gains persist over longer horizons than previously documented and, in turn, help in portfolio allocation decisions.

The study used these data to answer the question of whether return distribution, interdependence, and contagion dynamics differ between nontraditional-stamped bond indices (cryptocurrencies) and the indices of frontier WAMZ countries. Furthermore, in light of dated and recent global as well as regional financial crises, theses were analyzed to avoid biases in interpretations and recommendations (Tables 1 and 2).

Descriptive Statistics of the Variables

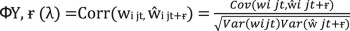

Figure 1 illustrates the fluctuations in sovereign bonds, which appear to mirror shocks in the cryptocurrency markets. This observation aligns with existing literature regarding the riskiness of both asset classes. (Das & Kannadhasan, 2018; Gil-A lana et al., 2020).

Source: Author, 2023.

The skewness values indicate that the returns of USDT and BTC have negative spikes. The Kurtosis values suggest positive leptokurtic behavior in the cryptocurrency markets. This means that cryptocurrency returns have ‘fat tails’ and are ‘more extreme’ than a ‘normal distribution. The Jarque-Bera’ test, which assesses the normality of the data, shows a likelihood far from normality (value < 0.01) for cryptocurrency returns. This is consistent with previous cryptocurrency studies regarding return distributions (Shanáev & Ghimire, 2021; Szczygielski et al., 2020).

Correlation analysis

In Table 3, it can be observed that some of the cryptocurrencies and bonds show a statistically significant positive relationship, while others exhibit a weak and insignificant relationship. The strong and statistically significant degree of association between bonds and cryptocurrencies suggests that diversification between cryptocurrencies and bonds is practically impossible; at worst, contagion between them may occur (Asafo-Adjei et al., 2021; Gil-Alana et al., 2020). Interestingly, the negative relationship between some bonds and cryptocurrencies indicates a diversification advantage.

Results and discussion

Global financial markets have experienced remarkable growth and transformation over the past few decades, with emerging and frontier economies becoming increasingly integrated into the global financial system. Frontier West African Monetary Zone (WAMZ) economies, comprising countries such as Nigeria, Ghana, Gambia, Guinea, Sierra Leone, and Liberia, have experienced significant growth in their financial markets, including their bond markets (Ilyas et al., 2022; IMF, 2023). These countries’ bond markets have played a crucial role in financing their respective governments’ fiscal needs and providing investment opportunities for institutional and individual investors.

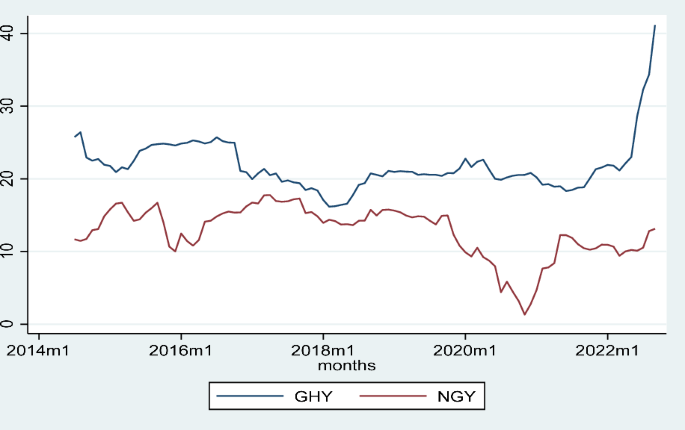

The results exhibit the statistical elucidation of the data with the help of the “biwavelet” conglomeration as used by Junior et al. (2017). To certify a dependable interpretation of the set of data under review, it is worth noting that arrows pointing to the right and those pointing to the left indicate that the securities being observed and their economic variable, respectively, are identical in their directional movement, indicating a positive correlation among the dependent and independent variables (i.e., “In-phase”). On the other hand, when the dependent and independent variables are said to move in opposite directions, then the variables are said to have a negative correlation (i.e., anti-phase). The right-pointing arrows upwards and the left-pointing arrows downwards indicate that the earliest (to begin with) variable is leading and vice versa for the left-pointing arrows upwards and right-pointing arrows downwards. Regarding the matching series’ interdependence, the surface color and the “color palette” are used as representations. The warm/red color represents periods or variables with vital interconnections. However, the cold/blue color represents a lesser sequence of interrelationships among the variables under observation, as posited by Frimpong et al. (2021), Kuffour et al. (2021), Owusu Junior et al. (2018). For any output, the decreases in the cone of influence (COI) zone are statistically insignificant (see Asafo-Adjei et al., 2021; Kuffour et al., 2021).

Figure 1 shows the comovements between the Ghana and Nigeria 5-year bond yield (ask-bid price) with three cryptocurrencies’ returns from January 2021 to October 2022. Figure 1 shows that bonds have short-, medium-, and long-term nexuses with cryptocurrencies. In the in-phase (positive comovement), as shown by the arrows, an increase in the value of cryptocurrency is related to an increase in the number of bonds. Furthermore, positive comovements between bonds (Ghana & Nigeria) and cryptocurrencies occur for BTC (14/06/2021 and 1/11/2021) and ETH (1/11/2021). The degree of relatedness between bonds and cryptocurrencies indicates the practical impossibility of using the WAMZ frontier bond as a hedging proxy or diversifier for said cryptocurrencies (BTC and ETH) and vice versa. Since positive correlations have no diversification advantage as far as building portfolios is concerned, investors will need to observe trends and periods that provide negative correlations or fewer movements between bonds and their crypto counterparts to find diversification, hedging, and safe heaven equilibriums. Advisably, between the BTC and ETH cryptocurrencies and the bonds under review depending on the market conditions.

The negative correlation (anti-phase) between bonds and cryptocurrencies indicates that cryptocurrencies can act as safe havens for most frontier bonds under turbulent market conditions. By inference, the negative comovements among the dependent and the independent variables indicate that bonds may serve as a hedging proxy for cryptocurrencies that occur in the middle of 2022, which confirms Baur & Lucey’s (2010) assertion. It was observed that the preceding era of 2021 had limited interdependencies between bonds and cryptocurrencies. Kristoufek (2020), Gurdgiev and O’Loughlin (2020), and Rubbaniy, Khalid et al. (2021) posited in their research that during the era of uncertainty within financial markets, the safe heaven property of most securities is eliminated; therefore, the above results confirm these earlier findings. According to Baur & Lucey (2010), investors may benefit from diversification when the portfolio is very well built. Figure 1 further illustrates the potential of diversification gains for investors who hold different cryptocurrencies, such as BTC, ETH, and USDT, over a longer time horizon with effective risk management strategies and frequencies over time.

Frequency-dependent analysis

The sample

The wavelet multiple correlation and multiple cross-correlation techniques allow for a simultaneous presentation of cryptocurrencies and bonds to examine their degree of interdependencies, integration, and whether any lead/lag variables exist over the investment horizon for the sampled datasets.

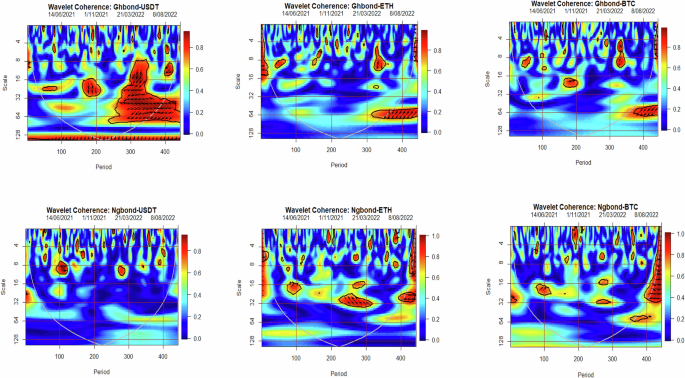

Figure 2 shows the wavelet bivariate correlation matrix, which provides insights into the average interactions between different variables at various time scales. This analysis goes beyond specific calendar times and instead focuses on revealing multiple interactions and the magnitude of averaged interactions or interdependencies over the sampled period.

Source: Author, 2023.

Bivariate contemporary correlations

Using a 5-scale wavelet table, shown on the bivariate contemporary correlation as exhibited in figure three. In the computation of the coefficient for the wavelet correlations, the parallel axis shows the likely combinations. A left to right transition will unearth the similitude among the five pairs as indicated C1 to C5 becomes weaker. On the other hand, the vertical axis represents the periods on the bivariate contemporary correlation at various wavelet scales and examines the relationship between two potentially merging time-series during the same period, as discussed in Asafo-Adjei et al. (2021) and Kuffour et al. (2021).

Figure 2 dispense the bivariate contemporary correlation matrix for the cryptocurrencies and the bond beyond the five wavelet scales, the outcome does not appear to alter vitally from the bivariate analysis. The results outturn was a combination of positive and negative correlation among the pairs. Specifically, BTC and ETH showed a higher degree of comovement with boundaries covering −0.255 to 0.822 at different time scales, which stood around 0.400 representing an utmost correlation variable. Followed closely were the ETH and USDT, Ghbond and Ngbond, Ngbond and USDT, Ghbond and ETH, respectively. The aforementioned comovements among the cryptocurrencies and between the cryptocurrencies and the bond are mostly positive, constituting intermediate and long-term real economic agreements.

The results are an indication that portfolio diversification among cryptocurrency pairs is impracticable. Again, it was observed that the practicability of diversification between cryptocurrencies was in question because of the contagion or the possibility of speculative bubbles among these pairs. A point up on earlier literature regarding utmost integration among various cryptocurrencies see, for example, Ji et al. (2019) and Maiti et al. (2020). In twist, the zestfulness of the comovements between the Ghbond and the BTC are not the same as above, this therefore, measures the fear and expectations of investors in the cryptocurrency market and the bond market. Nevertheless, the Ghbond is able to meter the magnitude of fear in BTC effectively at various time scales (short, medium, and long). There are very weak to negative comovements between Ghbond and the BTC. Impliedly, the Ghbond has the ability to be used as a diversifier for the BTC which investors can deploy to minimize their risks during the era of turbulence within the financial markets. This hedge advantage is not only limited to the Ghbond/BTC, but also, there are significant pairs that investors could also take risk mitigation advantages. For example, pairs like BTC and USDT, Ngbond and BTC, etc. These results, however, proxy the BTC as the most efficient cryptocurrency as a hedge variable among its peers and for frontier sovereign bonds during the era of uncertainties within the financial markets. This result again partially supports the assertion posited by Tiwari et al. (2019).

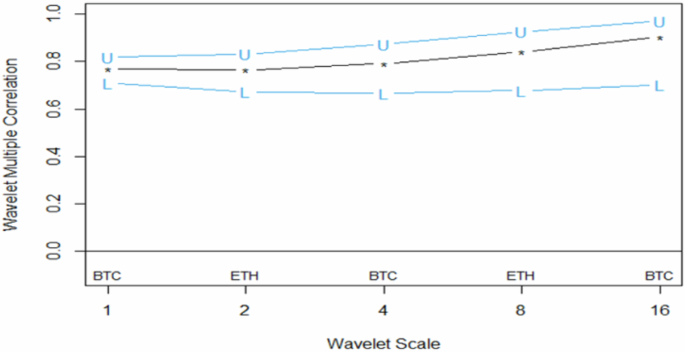

Wavelet multiple correlation (WMC)

Figure 3 and Table 4 present the frequency localization of the WMC of the cryptocurrencies and the bond nexus output series with the help of MODWT. The results among the three cryptocurrencies and between the cryptocurrencies and the bond regarding its interdependencies within the time-frame dynamics (i.e., short, medium, and long-term). We observed a higher degree of interdependence for the daily return series, peaking as high as 98.85% for the ‘wavelet multiple correlations’, 98.64% for the bottom bound, and 99.98% for the higher bound by approximation. A continuous augmentation of the WMC over a time horizon was observed. Indicating that a selected return of a daily variable could be used to explain the remaining variables at high approximation of about 98.85% with a margin of error of about 1.15%, on up to 16 interdependent on the wavelet scale. The divergence level of the cryptocurrencies did widen in the long term at scale 16, irrespective of the existence of the sovereign bond.

Note: GHBOND (C1), NGBOND (C2), BTC (C3), ETH (C4), and USDT (C5) Source: Author, 2023.

The analysis reveals that the WMC continues to increase over the time horizon, indicating a continuous augmentation of interdependencies between the variables. This indicates that the relationships between cryptocurrencies and bonds are strengthening over time, suggesting that these assets are becoming more interconnected in financial markets. However, it is noteworthy that the divergence level of cryptocurrencies widens in the long term at scale 16, regardless of the existence of sovereign bonds. This suggests that over longer time periods, the individual characteristics of the cryptocurrencies become more pronounced, leading to increased differentiation between them.

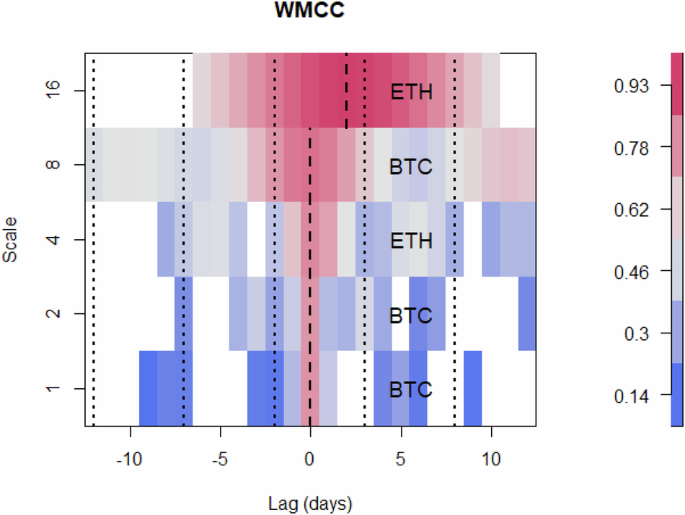

Wavelet multiple cross-correlations (WMCC)

Drawing from the methodologies employed by Boateng et al. (2022), Kuffour et al. (2021), and Asafo-Adjei et al. (2021), we present the wavelet multiple cross-correlation using a five-scale wavelet (refer to Table 5). In Fig. 4, the interpretations remain consistent with those observed in the initial stage of the wavelet multiple analysis, with the scales on the y-axis carrying similar meanings or interpretations. The lag length series is depicted on the x-axis, with each case representing 10 days, encompassing both positive and negative lags. Positive variables indicate lagging, while negative lags denote leading variables at their respective scales. A value of zero signifies neither lead nor lag in the localization table.

Note: Upper and lower limits at the 95% confidence intervals Source: Authors 2023.

We define localization as the maximum value attained in any linear combination of all potential variables at a specified wavelet scale, depicted by dashed lines among dotted lines for all lag variables. If a variable appears on the scale, it signifies that the variable holds the potential to lead or lag all other possible variables. Consequently, we infer that the variable at that scale holds the highest value among the linearly combined variables at its designated scale, assuming all other factors remain constant.

The economic interpretation of the wavelet multiple cross-correlation indicates the degree of interconnection among variables and identifies the most influential variable at a specified scale on the wavelet as either the first mover or the last variable to react to shocks (i.e., lead/lag variables). BTC is lagging in the first two days on the scale, day four saw ETH leads on the scale, however, on day 16 on the scale the ETH lags, representing short-term and medium-term dynamics. The BTC was the key cryptocurrency that was predominant in the lead/lag frequencies at various time scales (short, medium, and long terms) in an expectancy for short, med, and real economic transactions. We assume, therefore, that the ETH has overriding potential to either lead or lag in any linear amalgamation with other variables and may put up minimal market efficacy in the cryptocurrency.

We recommend that ETH proxy as a diversifier for the multiple (heterogeneous) localizations across numerous investment scopes. Notwithstanding, at scale 16, ETH was a bullish variable to shocks in comparison with all other variables under study; by extension, the ETH is the riskiest cryptocurrency to externalities during turbulence conditions. The ETH has been one of the most successful in terms of performance among its peers in a stiff competitive market. This result affirms current studies by Bouri et al. (2021) and Mensi, Hkiri, Al-Yahyaee, & Kang (2018) on the time-varying comovements’ structure of cryptocurrencies. However, it fundamentally digresses from Fama (1970) assertion of market efficiency studies and responds to Müller et al., 1997’s heterogeneous market hypothesis (HMH) and that of Lo (2004)’s adoptive market hypothesis (AMH) studies. Kuffour et al. (2021) posited that highly integrated financial markets result in difficulty in relatedness for negative shocks to ensuing contagion. These findings affirm accordingly.

The results in Fig. 4 indicate that in the first two days on the scale, BTC is lagging, while on day four, ETH leads on the scale. However, on day 16, the ETH lags again, constituting the duration trend dynamics over time. This demonstrates the varying lead/lag relationships between cryptocurrencies at different time scales (Boateng et al., 2022; Kuffour et al., 2021). The analysis identifies BTC as the key cryptocurrency that predominantly leads or lags in various time scales, indicating its potential for short-, medium-, and long-term economic transactions. Conversely, ETH shows the potential for lead or lag in any linear amalgamation with other variables, suggesting that it may have minimal market efficacy in the cryptocurrency market. The results align with those of previous studies (Bouri et al., 2021; Mensi, Hkiri, Al-Yahyaee, & Kang, 2018) that explored the time-varying comovement structure of cryptocurrencies and highlighted the difficulties related to negative shocks leading to ensuing contagion in highly integrated financial markets. These findings diverge from the traditional market efficiency studies of Fama (1970) but support the heterogeneous market hypothesis of Müller et al. (1997) and the adoptive market hypothesis of Lo (2004). Kuffour et al. (2021) posited that highly integrated financial markets increase the likelihood of negative shocks resulting in contagion, which these findings affirm accordingly (Fig. 5).

Source: Authors 2023.

Conclusion

This study provides valuable insights into the contagion dynamics between cryptocurrency returns and sovereign bond yields in the frontier economies of the West African Monetary Zone (WAMZ) area. Our findings highlight the limited direct correlation between these markets, but reveal significant spillover effects, particularly during periods of heightened market volatility, such as the COVID-19 pandemic and the Russia–Ukraine war. This highlights the importance of analyzing investors’ expectations and fears in the context of market dynamics, especially during these periods (Kuffour et al., 2021). Although the correlation between cryptocurrencies and bonds is limited, it supports the evaluation of cryptocurrencies’ potential role as a hedge in providing a safe-haven during market turbulence which aligns with (Bouri et al., 2021; Mensi, Hkiri, Al-Yahyaee, & Kang, 2018).

Given the observed contagion effects, policymakers in the WAMZ region should consider implementing time-sensitive, frequency-oriented strategies to mitigate the risks associated with cryptocurrency volatility and its potential impact on sovereign bond markets. Strengthening financial market regulation, improving institutional frameworks, and enhancing market transparency could help reduce the systemic risks posed by cryptocurrency markets within these economies. Furthermore, there is a need for targeted policies that address the macroeconomic challenges, such as currency depreciation, corruption, and high public debt, that exacerbate contagion risks in these economies.

The Morlet wavelet has certain limitations, including sensitivity to shifts and the inability to directly provide phase or directional information, which may reduce its effectiveness for certain financial market conditions or linear patterns. Additionally, it does not offer the same time-frequency resolution as the Fourier transform. However, despite these limitations, the Morlet wavelet is valuable in analyzing complex nonlinear processes in financial markets and monitoring market fluctuations. Last, the research on the relationship between sovereign bond yields and cryptocurrency returns in the WAMZ faces several limitations, including underdeveloped financial markets, low market liquidity, technological and infrastructure challenges, and investor behavior biases. Addressing these limitations is essential for accurate interpretation and for advancing more thorough analyses, which can improve policy decisions and financial market stability in WAMZ economies.

Future studies could explore the long-term effects of cryptocurrency market integration on the stability of frontier markets, particularly in relation to other asset classes like equities and commodities. Research could also investigate the impact of regional policies and financial innovations on reducing contagion between cryptocurrencies and sovereign bonds in the WAMZ area.

Responses