The impact of digital inclusive finance on enterprise digital technology innovation: empirical evidence from the Chinese manufacturing industry

Introduction

With the advancement of the scientific and technological revolution and industrial transformation, the digital economy has emerged as a critical driver for global economic expansion. Central to this transformative wave is enterprise digital technology innovation. By integrating cloud computing, big data, AI, and other cutting-edge technologies, enterprises can optimize production processes, enhance the quality of digital products and services, boost market competitiveness, and accelerate response times. This innovation extends beyond mere patent and intellectual property acquisition; it involves adapting organizational structures, management methodologies, and corporate culture—all essential for enterprise sustainability and progress. Consequently, elevating digital technology innovation levels has become a pivotal challenge in China’s economic digital transition. Recently, the rise of digital inclusive finance has opened new avenues for enterprises to innovate in digital technology. Unlike traditional finance, digital inclusive finance leverages various digital technologies such as mobile payments, online lending platforms, and fintech solutions to introduce online financial service paradigms. These innovations aim to expand financial service access, efficiently address exclusion issues, and increase financial service penetration and inclusivity (Zhang et al. 2024). Moreover, digital inclusive finance has become a core topic at the G20 summit. The summit has led the establishment of high-level principles for leveraging digital technology to enhance financial sector inclusion, reflecting the international consensus on achieving universal financial service coverage.

Moreover, prevailing literature broadly acknowledges the pronounced role of digital inclusive finance in bolstering corporate governance (Ma 2023a; Xu et al. 2023a; Tang and Geng 2024; Lu and Cheng 2024a). Firstly, from the standpoint of enterprises themselves, digital inclusive finance aids companies in better aligning with the novel market conditions and enhancing their current organizational frameworks and management standards (Li and Pang 2023), consequently elevating corporate governance outcomes. Secondly, considering the external milieu of businesses, the advocacy of digital inclusive finance diminishes information disparities and amplifies resource allocation efficiency (Sun and Tang 2022), facilitating enterprises to secure additional credit resources and achieve value augmentation.

The significance of digital inclusive finance transcends mere financial support; it also lies in its potential to enhance the efficiency of financial services through digital innovation. Consequently, it drives the digital transformation and upgrading of enterprises and accelerates the modernization of the real economy. On the one hand, due to the inherent uncertainties, information asymmetry, and diseconomies of scale in enterprise development (Bu et al. 2024), these factors can lead to elevated loan risk premiums and the digital paradox. The power law characteristics of social wealth distribution and the Matthew effect further exacerbate credit mismatches and structural imbalances. In this context, digital inclusive finance provides more accessible financial resources for all types of enterprises, particularly manufacturing firms, thereby reducing financing thresholds and stimulating real economic growth. On the other hand, innovative financial products and service models emerging from digital inclusive finance more effectively address the diverse financing needs of manufacturing enterprises, thus enhancing their innovative dynamism and growth potential. In essence, digital inclusive finance not only serves as a crucial catalyst for enterprises’ digital technological innovation but also acts as a robust support system for the healthy development of the real economy, injecting fresh momentum into the sustainable expansion of the global economy. Given China’s current economic landscape, the urgency and importance of digital transformation and inclusive finance are especially pronounced, as they are key drivers of high-quality economic development.

Currently, studies are increasingly focusing on the driving factors that influence enterprise digital technology innovation. Internally, total factor energy efficiency, strategic decision-making, supply chain management, human capital, and corporate social responsibility significantly impact this innovation. Externally, financing constraints, policy environment, and natural resource limitations have been examined in existing research. However, the underlying dynamic processes and mechanisms of digital technology innovation within enterprises remain inadequately explored. Therefore, a systematic investigation into the specific pathways and mechanisms encountered by Chinese enterprises in their digital technology innovation efforts is crucial. Despite existing research, a notable gap persists in understanding the impact of digital inclusive finance on enterprise digital technology innovation and its mechanisms, with limited exploration of their operational pathways. This study will emphasize external financing constraints, financial regulation intensity, internal R&D investment, and executives’ financial backgrounds, aiming to provide fresh insights into how digital inclusive finance promotes enterprise digital technology innovation. It also seeks to offer theoretical and empirical support for policy formulation.

This paper selects 3313 Chinese A-share manufacturing firms spanning from 2011 to 2022 as the research sample. This timeframe represents a pivotal era in China’s transition from traditional to intelligent manufacturing. Initially, the study examines the effects of digital financial inclusion on corporate digital technology innovation, analyzing its diverse impacts across three dimensions. To provide solid empirical support, methods such as variable substitution, model specification, lagged variables, and instrumental variables are employed for robustness and endogeneity checks. Secondly, the paper explores the intermediary role of financing constraints and R&D investment in the relationship between digital inclusive finance and corporate digital innovation. Subsequently, it investigates how executives with financial backgrounds and the stringency of financial regulation moderate the relationship between digital inclusive finance and corporate digital technology innovation. Finally, the study delves into the impact of property rights and regional heterogeneity on these connections.

The research reveals that digital inclusive finance significantly boosts enterprise digital technological innovation, with its coverage breadth being crucial. Financing constraints and R&D investments serve as primary channels driving this innovation via digital inclusive finance. Executives’ financial backgrounds negatively moderate the link between digital inclusive finance and enterprise digital technological innovation, while financial regulatory intensity exhibits an inverted U-shaped moderation effect. Furthermore, the stimulatory impact of digital inclusive finance on enterprise digital technology innovation is more pronounced in central and western regions and among non-state-owned enterprises.

In summary, the marginal contributions of this paper include: (i) Confirming through theoretical and empirical analysis the crucial role of digital inclusive finance in advancing enterprise digital technological innovation. (ii) Exploring the mediating effects of financing constraints and R&D investment on the relationship between digital inclusive finance and corporate digital technological innovation, thereby revealing the pathways through which digital inclusive finance influences corporate digital innovation output. (iii) Further validating both the linear and non-linear moderating impacts of executives with financial backgrounds and financial regulatory intensity on the relationship between digital inclusive finance and corporate digital technological innovation. (iv) Introducing a novel incentive mechanism to enhance enterprises’ digital technological innovation capabilities in China, providing theoretical and empirical support for the reform of China’s digital inclusive finance system and the improvement of corporate digital innovation performance.

Theoretical analysis and research hypothesis

Digital inclusive finance and enterprise digital technology innovation

Digital inclusive finance represents an innovative financial approach that integrates traditional services with cutting-edge digital technologies. Its core objective is to expand financial service access by reducing entry barriers, lowering transaction costs, and enhancing service availability. According to the resource-based view (RBV) theory (Barney 2001), digital inclusive finance constitutes a valuable, scarce, and non-replicable asset, enabling firms to secure sustainable competitive advantages through technological advancements. By enhancing financial service accessibility—owing to reduced market entry barriers and lower transaction costs—digital inclusive finance facilitates more efficient acquisition and utilization of financial resources, thereby fostering digital transformation and enterprise innovation. The unique attributes of this resource allow firms that effectively leverage digital inclusive finance to achieve superior market competitiveness.

Information Processing Theory underscores how organizations process and react to external information (Yadav et al. 2024). Digital inclusive finance improves the efficiency of both internal and external oversight by mitigating information asymmetry. This enhanced transparency builds trust between stakeholders and enterprises, strengthens internal controls, and creates a conducive environment for decision-making and operations during the digitalization process. Leveraging technologies such as blockchain, big data, and cloud computing, digital inclusive finance increases information transparency and regulatory effectiveness, addressing issues like equity dilution, commercial bribery, and illegal disclosure while significantly reducing agency costs (Lu and Cheng 2024a).

Innovation diffusion theory describes the spread of new ideas, behaviors, and products throughout society. As an innovative financial service model, digital inclusive finance attracts social capital through digital platforms, reduces marginal costs associated with market development and financial operations, lowers information collection and user conversion costs, and eliminates financing barriers, thus promoting direct financing (Zhang et al. 2024). It not only reflects the scale and long-tail effects of the financial market but also caters to diverse market demands, providing financial support for various enterprises engaged in digital technology innovation. The advancement of digitalization helps enterprises overcome psychological barriers when accessing financial services and alleviates issues such as price exclusion, market exclusion, and self-exclusion. Additionally, the widespread adoption of digital technology encourages enterprises to explore new business models and service methods to maintain competitiveness, accelerating the pace of digital technology innovation and application.

In conclusion, digital inclusive finance not only enhances enterprises’ ability to secure funds through more transparent and efficient financial services but also stimulates innovation activities by reducing transaction costs and improving capital accessibility. This dual effect promotes high-quality economic development at both macro and micro levels.

Based on these insights, this paper proposes Hypothesis 1: All other things being equal, there is a positive impact of digital inclusive finance on corporate digital technology innovation.

Transmission mechanism: the intermediary role of financing constraints and R&D investment

Digital inclusive finance may influence enterprise digital technology innovation in two potential ways: financing constraints and R&D investment.

Financing constraints, as a form of market friction, theoretically limit enterprises’ reliance on external funds. Given that China’s financial market is still in its developmental stage, the financial system remains imperfect, with deficiencies in the credit market and issues such as poor corporate credit records or insufficient transparency of financial information (Yao and Long 2024). Consequently, the financial system struggles to meet the financing needs of private small and medium-sized enterprises (SMEs), exacerbating the Macmillan Gap (Wang 2023). In this context of constrained financing, enterprises face limitations in their investment capacity, which directly impacts their ability to undertake long-term and highly uncertain digital technology innovation projects. The current status of ongoing projects becomes at risk when organizations decide to terminate them after implementation has started. The theory of agency predicts management during times of financing constraints may give up innovation projects with positive net present value (NPV) because of short-term interests, thus worsening investor conflicts and agency costs.

However, advancements in digital inclusive finance present viable solutions to these financial limitations. Digital inclusive finance decreases expenses related to finance and enhances the availability of financial services, thus helping companies manage risks linked to digital technology innovation projects. Through digital inclusive finance, financial institutions can evaluate a company’s credit risk precisely and enhance credit extension to a large extent (Mali and Yeboxia 2020). Flexibility in repayment or financial products with flexibility in financial burdens during the R&D and technology conversion phases is able to be devised on one hand by financial institutions for enterprise cash flow unpredictability. However, digital inclusive finance provides other sources of funding and lower financing rates that are more suitable for businesses’ particular financing needs and cash flow requirements. It is important to relieve the external financing constraints of an enterprise during its growth stage and boost its digital technology innovation capability. With the quicker pace of digital technology advancement, businesses must keep increasing the pace in applying new technological or digital advancements. Digital inclusive finance is a catalyst for this adaptation, based on the availability of the required funding. The funds allocated by enterprises for new technology investments, human capital development, and streamlining the innovation process help them gain an edge in the fierce competition in the market.

Based on this, this paper proposes Hypothesis 2a: All else being equal, digital inclusive finance promotes corporate digital technology innovation by alleviating financing constraints.

The R&D investment plays a crucial role in enhancing enterprise innovation and high-quality development. Excess returns and favorable signals can be produced by enterprises through R&D activities and strengthen enterprise value. However, investment in R&D often faces challenges such as high asset specificity, information asymmetry, uncertain outcomes, and mismatches between investment returns, which often lead to agency problems and increased credit risk for enterprises (O Connell et al. 2022). Additionally, the lack of funding, inefficient management, and malfunctioning market systems are frequent hindrances to innovation (Sun et al. 2024). Nevertheless, the advent of digital inclusive finance has adopted traditional financial services broader than ever before, and the latter has also offered fresh ways to tackle challenges.

In the first place, digital inclusive finance leverages informatization and big data technology to reduce costs of financing and lower the barriers to accessing financial services (Peng et al. 2024), and enables enterprises to allocate capital with more agility and lower risks associated with asset specificity. Second, digital inclusive finance advances digital technological innovation through the application of technologies such as cloud computing, big data, and the mobile internet, which increase the quality and speed of digital technological innovation. Taking advantage of information asymmetry, the problem of information asymmetry is resolved through the establishment of risk control and information monitoring frameworks that help financial institutions grasp a complete understanding of business scenarios (Guo et al. 2024). Moreover, digital inclusive finance brings professional evaluation institutions and models, which provide a more accurate matching between project risks and financial resources. In addition to that, this approach also provides a comprehensive analysis of the market prospects and technological feasibility of R&D projects and consequently reduces the impact of output uncertainty. Financial institutions can offer customized investment solutions and risk-sharing mechanisms to investors and enterprises to share the returns of investment more fairly. Thus, it increases investor confidence and induces more R&D investment (Ayaz et al. 2025).

Furthermore, digital inclusive finance provides solutions to fill the funding gaps and rejuvenate or even improve the innovation framework of the high-tech manufacturing sectors, especially when external economic disruptions strike them. It also facilitates information dissemination and collaborative efforts, enabling R&D teams to operate more efficiently. By leveraging contemporary financial instruments such as digital payments and fintech solutions, business operators not only increase their willingness to engage in innovative activities but also significantly boost their R&D expenditures, thereby fostering technological advancements and product evolution. In essence, digital inclusive finance enhances R&D investments for enterprises through more effective financial services, ultimately stimulating innovation in digital technologies.

Based on this, this paper proposes Hypothesis 2b: All else being equal, digital inclusive finance promotes enterprises’ digital technological innovation by increasing R&D investment.

Boundary effect: the regulatory effect of executives with financial backgrounds and the intensity of financial regulation

Since the characteristics and experience of the executive team can significantly influence a firm’s strategic choices, executives with a financial background may prioritize financial performance and the stability of traditional financial instruments based on their expertise and cognitive patterns (Li and Kong 2024). From the perspective of agency theory, managers possess control over corporate resources, and the constraints imposed by owners on their behavior may be limited. While traditional theories tend to view managers as fully rational “Economic Man” who act according to the principle of expected utility maximization and Bayesian learning, existing research has shown that corporate executives often exhibit short-sightedness in their economic activities, which can crowd out corporate governance and investment in innovation (Liu et al. 2020).

First, executives with a financial background may exhibit a preference for short-term financial outcomes and neglect long-term strategic planning. Due to loss aversion, they may reduce investment in digital technology innovation while pursuing financial stability (Gu 2023). There are many advantages of these executives’ financial expertise, such as overcoming the firms’ financing constraints and offering strong financial support, but at the cost of long-term nonfinancial performance.

Second, executives with a financial background may be more likely to rely on traditional financial resources rather than innovating resources from the digital technological field, which may restrict the firm’s expansion in the digital field. Therefore, while executives with financial backgrounds can provide a financial prop for firms, they may reduce the motivational effect of digital inclusive finance on firms’ digital technological innovations.

Furthermore, research in behavioral finance shows that managers have characteristics of limited rationality and that overconfident managers prefer endogenous financing over exogenous financing (Agha and Pramathevan 2023). This means that executives with financial backgrounds are likely to keep the cash inside the firm and reduce cash dividends. Such preferences can result in reduced investment in digital technology innovations, thereby limiting firms’ growth in the digital space.

Based on this, this paper proposes Hypothesis 3a: All other things being equal, an executive’s financial background diminishes the role of digital inclusive finance in promoting firms’ digital technological innovation.

As such, the dilemma associated with the tradeoff between financial efficiency and security is increasingly prominent following the occurrence of phenomena including P2P unraveling, users information leakage, platform monopolization, and data misuse (Xu et al. 2023b). The complexity, endogeneity, and volatility of digital inclusive finance have exacerbated the inadequacy of current regulation; that is, there is no single approach that would fit all the challenges of digital inclusive finance. fintech and digital finance that is inappropriate for financial regulation may hinder enterprise innovation with limited development and efficacy of fintech and digital finance due to the financial regulatory reform lagging behind (Ren et al. 2024). Consequently, the direction and degree of financial regulation are important for the formation of digital inclusive finance and can directly affect the development of different financial industries.

To effectively reduce financial market arbitrage, prevent and resolve liquidity risks, and support the healthy and orderly development of digital inclusive finance that better serves the real economy, moderate financial regulation can provide a stable policy environment for its growth (Xuan et al. 2024). This level of regulation successfully addresses traditional financial sector problems, promotes digital technological innovation in businesses, and aids in creating a standardized and orderly financial sector. Furthermore, prudent and effective financial regulations can enhance the targeting and security of digital inclusive finance, facilitate the precise provision of digital financial products, and mitigate micro-risks like credit and liquidity. This, in turn, increases the accessibility and depth of digital finance utilization for businesses (Qi and Sun 2024).

However, when the intensity of financial regulation exceeds a certain threshold, its detrimental impacts start to show. Overly stringent regulation may decrease incentives for innovation, raise compliance costs for businesses, and restrict the potential for innovation in digital inclusive finance. Moreover, overly stringent regulations risk undermining market competition mechanisms, stifling business innovation, and causing innovative digital inclusive financial products to disappear from the market, thereby impeding the advancement of enterprises’ digital technological innovation.

Therefore, this paper proposes Hypothesis 3b: All else being equal, the intensity of financial regulation produces an inverted U-shaped moderating effect between digital inclusive finance and firms’ digital technological innovation.

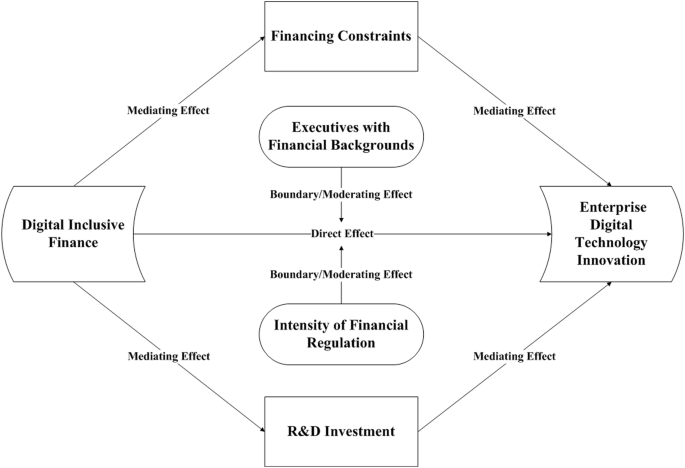

Based on the above research assumptions, the theoretical model of this paper is shown in Fig. 1.

Theoretical model.

Data and methodology

Sample data

This paper utilizes data from 3313 Chinese A-share manufacturing companies listed from 2011 to 2022, with the manufacturing sector classified according to the China Securities Regulatory Commission’s (CSRC) 2012 industry classification. The identification of digital patents innovatively employs a BERT-based model; corporate digital technology innovation is measured by the number of applications for digital patents. During robustness tests, the dependent variable is replaced by the number of authorized digital patents, examining the impact of inclusive digital finance on corporate digital technology innovation from both quantitative and qualitative perspectives. Data on inclusive digital finance are sourced from the “Peking University Inclusive Digital Finance Index,” while microfinancial and corporate governance data are obtained from the China Economic and Financial Research Database (CSMAR), Wind Economic Database, and China Economic and Financial Database (CCER).

Adhering to established research methodologies, the initial samples undergo screening based on the criteria listed below: (i) Exclude samples pertaining to the finance and insurance sectors; (ii) Exclude samples designated as ST (Special Treatment) or PT (Particular Transfer); (iii) Exclude insolvent samples; (iv) Exclude samples featuring missing variables. Subsequent to this screening process, a final unbalanced panel dataset comprising 11,401 company-year observations is derived. To mitigate the impact of extreme values, all continuous variables undergo Winsorization at the 1st and 99th percentiles.

Variable selection and definition

-

(1)

Dependent variable

The dependent variable is corporate digital technological innovation (lndigital). Most existing studies measure it from two perspectives: input into innovation and output of innovation. In the core empirical section of this paper, the number of applications for digital invention patents (lninvention) and digital utility model patents (lnutility), which are part of the output of innovation, serve as proxy variables for digital technology patents.

Given the tens of millions of patents, manually reviewing each abstract to identify digital technology patents is impractical, posing a fundamental challenge in acquiring basic research data within this domain. To address this challenge, this paper employs advanced artificial intelligence technology, utilizing a classifier based on the BERT (Bidirectional Encoder Representations from Transformers) language model to automate the identification process. Figure 2 illustrates the key steps involved in identifying digital technology patents using this approach.

Fig. 2

Major steps in digital technology patent identification.

During the identification of digital technology patents, this paper primarily employs the patent database sourced from China’s National Intellectual Property Administration. This database encompasses patents filed and disclosed by the administration from the enforcement of the Patent Law in 1985 to 2022, totaling over 34.78 million records. It contains fundamental patent details such as type, application date, applicant, address, classification code, and abstract.

Based on the stratified sampling principle, this study randomly selected 60,000 patents using 4-digit IPC (International Patent Classification) codes. Preprocessing steps were undertaken to facilitate subsequent analysis: (i) eliminating duplicate granted patent publications; (ii) extracting city information from patent addresses; (iii) excluding design patents lacking digital innovation connotation and those with severely incomplete abstracts. Patents’ abstracts provide details on the application field, function, and purpose, making it feasible to identify digital technology patents via abstracts, assuming each abstract is read and its meaning precisely grasped.

Considering the difficulty of manually identifying 60,000 patents, we first utilized the open-source GLM3 large language model to preliminarily determine whether these 60,000 patents belong to the category of digital technology patents. The key prompt used was: “Based on your knowledge, please determine if the following patent abstract pertains to digital technology patents. Here is the specific information of the patent abstract: Title + Abstract + Claims.”

On the basis of the preliminary judgment by the GLM3 large language model, 20 students were invited to carefully study relevant policy documents on digital technology, including the “Classification of Core Industries in the Digital Economy and the Corresponding International Patent Classification (2023),” the “14th Five-Year Plan for the Development of the Digital Economy,” the “Overall Layout Plan for the Construction of Digital China,” and over 30 other core documents. These students then manually reviewed the 60,000 patents to verify the accuracy of the GLM3 large language model’s analysis and reasoning.

To ensure the reliability of digital technology patent identification, 20 students were divided into two groups for independent assessments. For patents with differing judgments, cross-validation was conducted, followed by group discussions to reconcile discrepancies. Table 1 summarizes the manual classification outcomes, displaying only a segment due to space constraints. From an initial pool of 60,000 patents, 48,000 were randomly selected for training, 6000 for development, and another 6000 for testing. The training parameters are also listed in Table 1.

Table 1 Manual classification results (partial) and The BERT model training parameters. Based on the BERT language model, the patent text classifier exhibited exceptional performance. By adjusting the random seed and replicating the training process ten times, the training set’s prediction accuracy surpassed 99%, whereas the accuracy in the development and test sets ranged between 95% and 97%. Subsequently, the BERT model with optimal prediction performance among these ten iterations was chosen for further classification of digital technology patents. The model possesses a Type I error rate of 4.47%, implying a 4.47% probability of misclassifying non-digital technology patents as digital; it also has a Type II error rate of 3.66%, signifying a 3.66% probability of misclassifying digital technology patents as non-digital. This underscores the high accuracy and generalization capability of the BERT model in identifying digital technology patents.

The third step entails utilizing the well-trained BERT language model for predicting patent categorization into digital technology patents. Figure 3 displays the identification results. It is evident that the annual number of applications and grants for digital technology patents, alongside the number of applicant enterprises, exhibit an upward trend. This concurs with the development trajectory of China’s digital economy. Notably, an increase in digital technology patent applications commenced around 2001, potentially correlated with China’s accession to the World Trade Organization (WTO). Trade liberalization fosters corporate technological innovation via market and technology spillover effects. To some extent, this validates the reasonableness of the method employed in this study for identifying digital technological innovation.

-

(2)

Independent variable

The digital inclusive finance (DIF) serves as the independent variable. Most prior research has measured China’s advancement in digital inclusive finance using the Peking University Digital Inclusive Finance Index. This index, jointly developed by Peking University’s Digital Finance Research Center and Ant Technology Group, encompasses three dimensions: depth of digital financial utilization (Depth), breadth of digital financial coverage (Breadth), and the level of digitalization in inclusive finance (Digi). Consequently, in this paper’s core empirical analysis, we adopt the municipal-level digital inclusive finance index as a proxy for digital inclusive finance, following the methodology of Liu et al. (2021), Zhou et al. (2023). During the robustness test, the provincial-level digital inclusive finance index is used as an alternative measure for the explanatory variable. Additionally, given that the scale of the digital inclusive finance index is notably larger and not directly comparable to the digital technological innovation index of manufacturing enterprises, the index value is divided by 100 to ensure comparability.

-

(3)

Mediator variables

This paper selects financing constraints (SA) and R&D investment (RI) as mediating variables, serving as key components in the transmission mechanism through which digital inclusive finance influences enterprises’ digital technology innovation. Specifically, the degree of an enterprise’s financing constraint is inversely related to the absolute value of the SA index; a lower SA index indicates tighter financing constraints. Meanwhile, the level of an enterprise’s R&D investment is measured by the ratio of its expenditures on digital patents to sales revenue.

-

(4)

Moderator variables

Drawing from the studies by Li et al. (2023) and Lu and Cheng (2024b), this paper identifies executive financial background (Finance) and financial supervision intensity (Supervision) as moderating factors. Specifically, the dummy variable for senior executives’ financial background is assigned a value of 1 if they have experience in financial institutions like regulators, commercial banks, policy banks, or securities firms; otherwise, 0. Financial supervision intensity is gauged by the standardized ratio of provincial financial regulatory expenditure to financial industry added value, multiplied by 100.

-

(5)

Control variables

Fig. 3

Digital technology patent applications and licensing trends.

The main references of this paper are Ma (2023b) and Fu et al. (2024). The following control variables are selected: (i) firm characteristics variables, including size, age, return on net assets, and gearing ratio; (ii) corporate governance variables, encompassing duality of CEO and chairman positions, audit opinion, ownership nature, board size, proportion of independent directors, and shareholding concentration. Additionally, year and industry dummy variables are included to control for year and industry fixed effects.

Table 2 provides the precise definitions of these variables.

Model specification

Drawing on the methodologies of Guo et al. (2023) and Lee et al. (2023a), the following model is constructed to examine the promotion effect of digital inclusive finance on enterprises’ digital technological innovation and its underlying mechanism:

Among these, regression model (1) serves as the baseline regression model. The dependent variable is enterprise digital technology innovation (lndigital), and the independent variable is digital inclusive finance (DIF). This model tests whether digital inclusive finance has a promoting effect on digital technological innovation, thereby verifying Hypothesis H1.

For regression models (2)-(3), the dependent variables are financing constraint (SA) and R&D investment (RI), respectively, with digital inclusive finance (DIF) as the independent variable. These models examine the mediating effects of financing constraints and R&D investment on the relationship between digital inclusive finance and digital technological innovation. Regression models (4)-(5) explore two mediating mechanisms through which digital inclusive finance affects firms’ digital technological innovation, testing research hypotheses H2a and H2b.

Models (6)-(7) are moderated-effects models where the independent variable is digital inclusive finance, and the moderating variables are the financial background of executives (Finance) and the intensity of financial supervision (Supervision), to test hypotheses H3a and H3b.

The subscripts in all regression models denote industry (i) and year (t), with representing industry variables and representing year variables; represents estimated regression coefficients; represents the random disturbance term; and denotes control variables. The subscripts in all regression models (i) and (t) denote industry and year, respectively, and (i) denotes industry variables, and (t) denotes year variables; (alpha) is the estimated regression coefficients; ({varepsilon }_{{it}}) is the random disturbance term;({{Control}}_{{it}}) are control variables.

Empirical results and interpretation

Descriptive statistics

The descriptive statistics for the primary variables are presented in Table 2: (i) For corporate digital technology innovation (lndigital), the minimum value is 0, the mean is 0, the maximum value is 5.529, and the standard deviation is 1.392. These statistics indicate significant variation in the level of digital technology innovation among listed companies across various manufacturing industries, with at least half of the sample firms reporting no output related to digital technology innovation. (ii) The independent variable digital inclusive finance (DIF) shows variations in the development status of digital inclusive finance across different Chinese cities. The overall field remains in the deepening promotion stage. Specifically, digital inclusive finance has a minimum value of 0.490, a maximum value of 3.216, a mean of 2.318, and a standard deviation of 0.697. (iii) Among the mediating variables, financing constraints (SA) have a minimum value of 2.834, a maximum value of 3.614, a mean of 3.396, and a standard deviation of 0.129. Research and development investment (RI) has a minimum value of 0, a maximum value of 20.330, a mean of 4.311, and a standard deviation of 3.552, indicating significant variation in R&D investment levels across different businesses. (iv) Executive financial background (Finance), a dichotomous moderating variable, has a median of 1, suggesting that at least half of the corporate executives have experience working in financial institutions such as commercial banks, policy banks, and securities firms. Financial regulatory intensity (Supervision) ranges from a minimum of 0.007 to a maximum of 14.076, with a mean of 0.907 and a standard deviation of 0.987, indicating substantial variation in financial supervision levels between provinces. (v) All control variables exhibit standard deviations less than 1, suggesting moderate variation within these variables.

Correlation analysis

Additionally, this study conducted a Pearson correlation coefficient test on the primary variables to ensure the accuracy of the regression results and mitigate potential multicollinearity issues. As shown in Table 3, the correlation coefficients between digital inclusive finance (DIF) and enterprise digital technology innovation output are all significantly positive at the 1% level, supporting Hypothesis 1. Other factors that significantly influence the impact of DIF on enterprise digital technology innovation include firm size, leverage (lev), duality of CEO and chairman positions (dual), ownership concentration (top1), board size (board), proportion of independent directors (indep), and audit opinion (sole). Furthermore, it is reasonable to assume that the model will not suffer from significant multicollinearity issues, as the correlation coefficients between the main control variables and digital inclusive finance are relatively low.

Baseline regression

Based on research model (1), the impact of digital inclusive finance on enterprise digital technology innovation was examined using multiple regression analysis to test the causal relationship between the two. The results of the benchmark regression are presented in Table 4. The regression coefficients for the explanatory variables digital inclusive finance, innovation, and utility in columns (1)–(3) are 0.554, 0.498, and 0.353, respectively, all significant at the 1% level. These findings confirm the driving force behind enterprise digital technology innovation. The conclusion is consistent with the studies of Xiong et al. (2023) and Ma (2023a), indicating that when other control variables are held constant, enterprise digital technology innovation remains significantly influenced by digital inclusive finance. Specifically, higher levels of digital inclusive finance development are associated with better performance in enterprise digital technology innovation, supporting Hypothesis H1.

Dimension regression

To investigate the differential impacts of various dimensions of digital inclusive finance on the digital technological innovation of manufacturing enterprises, this study further analyzed three key dimensions of digital inclusive finance: Coverage (Breadth), Use Depth (Depth), and Digitalization Level (Digi). Utilizing regression model (1), this paper systematically examined the specific effects of these dimensions on enterprise digital innovation. The data in columns (1), (4), and (7) of Table 4 reveal significant positive relationships: the impact coefficients for coverage, use depth, and digitalization level are 0.459, 0.288, and 0.138, respectively, and these results are significant at the 1%, 1%, and 5% levels. These findings not only support Hypothesis H1 but also highlight that the coverage dimension has a particularly significant effect on enhancing enterprise digital innovation capabilities, underscoring the importance of expanding the coverage of digital inclusive financial services to boost enterprise digital innovation. This conclusion is consistent with the studies of Du et al. (2023) and Li et al. (2025).

Further detailed examination of columns (2), (5), and (8) in Table 4 reveals impact coefficients of 0.411, 0.279, and 0.083 for the coverage, use depth, and digitalization level aspects of digital inclusive finance on enterprise invention patent applications (lninvention), respectively. Conversely, columns (3), (6), and (9) show coefficients of 0.317, 0.141, and 0.008 for these dimensions on enterprise utility model patent applications (lnutility). These findings suggest that digital inclusive finance has a notably stronger influence on invention patent applications compared to utility model patent applications. Given that invention patents typically signify technological advancements and innovations, while utility models focus on enhancements in product form, structure, or combinations, this disparity indicates that digital inclusive finance may be more effective in fostering significant technological innovation, which requires higher R&D investments and involves greater innovation risks.

Robustness analysis

-

(1)

Substitution of explained variable

First, since only patents that have passed the Patent Office’s examination and are deemed creative, feasible, and industrially applicable can be authorized, the number of granted patents is typically regarded as an indicator of the quality of innovation achievements. Building on the methodology of Chi and Wang (2022), this study uses the number of granted digital technology patents, granted digital invention patents, and granted digital utility model patents as alternative dependent variables. The regression results in Columns (1)–(3) of Table 5 show impact coefficients of 0.531, 0.436, and 0.391, respectively, all significant at the 1% level. These findings suggest that digital inclusive finance also enhances the quality of enterprises’ digital technological innovation, supporting Hypothesis H1.

Table 5 Robustness analysis. -

(2)

Substitution of explanatory variables

This paper builds on the approach of Jiao et al. (2024) by using provincial-level data on digital inclusive finance as an alternative explanatory variable. The impact coefficients from these regressions, displayed in Columns (1)–(3) of Table 5, confirm the robustness of the earlier conclusions. This is because data at different levels may reflect distinct economic phenomena and patterns. Specifically, municipal data on digital inclusive finance may better reflect local financial activities and services, while provincial data capture broader regional economic characteristics and policy effects more comprehensively.

Secondly, considering that it is common practice to use a two-way fixed effects model of time and industry in regression models, which may not strictly control for endogeneity, this paper adopts (Wu 2020)’s method of controlling for higher-order joint fixed effects of “Year×Industry”. The regression results, shown in columns (4)–(6) of Table 5, reveal impact coefficients of 0.551, 0.490, and 0.359, respectively, all significant at the 1% level. These findings indicate that the development of digital inclusive finance continues to exhibit a significant innovation-driven effect on corporate technological innovation.

-

(3)

Change in the measurement model

Firstly, as the dependent variable is patent output, the descriptive statistics exhibit a mixed data structure, featuring an abundance of zero values alongside a continuous distribution of positive values. This paper adopts the methodology of Bai and Lin (2024) and applies the Tobit model to further investigate the influence of digital inclusive finance on corporate digital technological innovation. Secondly, to evaluate enterprises’ inclination towards innovation, this study constructs a dummy variable contingent on whether the number of digital patent applications is zero and utilizes the Logit model for robustness checks. Furthermore, considering that the patent count constitutes a count variable, the Poisson model is more appropriate for analyzing such data; accordingly, this paper also employs the Poisson model for robustness verification. Moreover, recognizing innovation input as a crucial determinant of patent output, this study includes the lagged indicator of innovation input as a control variable. The regression outcomes are displayed in columns (1)–(3) of Table 5. Notably, after utilizing diverse econometric models and controlling for the effect of innovation input on patent output, the coefficient of digital inclusive finance on corporate digital technological innovation remains markedly positive, affirming the robustness of the previous findings.

Endogeneity analysis

While the aforementioned test results confirm the hypothesis linking digital inclusive finance development to enterprise digital technological innovation, a mutual causality may exist between them. To address this, the paper initially employs the one-period lag of digital inclusive finance as an explanatory variable. Table 6, columns (1)–(3), presents regression results indicating that this lagged variable also promotes enterprise digital technological innovation, thereby partially mitigating endogeneity concerns. Moreover, the paper applies the methodology of Zheng et al. (2024) to further address potential endogeneity issues.

Specifically, the terrain undulation (TU) of each Chinese prefecture-level city region is employed as an instrumental variable, and it is regressed using the instrumental variable method. Complex topography areas may require greater investment in Internet infrastructure to support digital inclusive finance. Such geographic characteristics are typically not directly related to firms’ innovation decisions in the region, thereby satisfying the exclusion restriction for the instrumental variable. The first-stage regression result, shown in column (4), indicates that terrain undulation has a significant negative effect on the development of digital inclusive finance. The second-stage regression results, presented in columns (5)–(7), show that the regression coefficients for digital inclusive finance remain significantly positive at the 5% level, indicating that Hypothesis H1 remains robust and reliable even after accounting for endogeneity.

Mechanism test

Intermediary mechanism test

The test of the mediation mechanism for easing financial constraints is conducted first. As shown in column (2) of Table 7, the development of digital inclusive finance can alleviate financing constraints to some extent. The regression coefficient of digital inclusive finance on financing constraints is −0.095, significant at the 1% level. Subsequently, the combined effect of financing constraints and digital inclusive finance on enterprise digital technology innovation is examined. The findings presented in column (3) indicate a significant positive correlation between digital inclusive finance and enterprise digital technology innovation, with a smaller regression coefficient compared to column (1). This implies that the relationship between digital inclusive finance and enterprise digital technology innovation is partially mediated by financing constraints.

A possible reason is that businesses that are undergoing financial distress may not have their initial outlays sufficient enough to cover fixed costs, thus not being able to fully engage in direct financing activities or fully execute their investment plans for digital technology innovation. The use of digital technology to mitigate digital finance provides inclusive digital finance, which reduces information asymmetry and helps financial institutions assess credit risk more accurately and provide customized financial services to businesses. Thus, this closes the gap between internal and external costs of capital, eases the financing constraints, and improves businesses’ digital technology innovation ability. The findings are in agreement with the research done by Bu et al. (2024) and Liao et al. (2025).

Second, the mediation mechanism test aimed at boosting R&D investment is performed. As shown in column (4) of Table 7, the findings of digital inclusive finance on R&D investment are very significant at a 1% level. Such advancement of digital inclusive finance means that it assists in widening the financing avenues and strengthens the protection of enterprise R&D investment. Second, the interaction between R&D expenditure and digital inclusive finance on businesses’ adoption of innovative digital technology is studied. Column (5) demonstrates that the effect of digital inclusive finance on enterprise digital technology innovation is still significant at the 1 percent level, and the regression coefficient is lower than column (1). This, in turn, suggests that R&D investment partially acts as a mediator in the relationship between digital inclusive finance and enterprise digital technology innovation. Therefore, Hypothesis H2b is supported by the effect of digital inclusive finance on enterprise digital technology innovation through augmenting R&D investment.

This is in line with the research of Tian et al. (2020) and Zhang et al. (2024). A plausible explanation for this is that digital inclusive finance transcends resource constraints and introduces innovative methods to address challenges such as cash flow restrictions, inefficient management, and inadequate market support for corporate R&D investments. Enhanced R&D expenditures enable enterprises to undertake new initiatives, fostering product innovation, securing market competitiveness, and establishing their credibility.

Moderating mechanism test

This paper further examines the moderating effect of executive financial background on the relationship between digital financial inclusion and firms’ digital technology innovation. Columns (1)–(3) of Table 7 report the regression results, showing that the interaction term between digital inclusive finance and executive financial background (DIF*Finance) has a negative effect on firms’ digital technological innovation, significant at the 1% level. This indicates that executive financial background negatively moderates the relationship between digital inclusive finance and firms’ digital technological innovation, weakening the promotion of digital inclusive finance on firms’ digital technology innovation. The conclusion is consistent with the study of Lu and Cheng (2024c).

The reasons for this negative moderating effect may be reflected in the following four aspects: first, executives with financial backgrounds may prioritize internal control and risk prevention, potentially failing to establish effective incentive mechanisms to encourage employees to pursue digital technological innovations; Second, even if executives recognize the importance of innovation, they may focus more on the scale of innovation inputs rather than the benefits and quality of innovation outputs, leading to an emphasis on pursuing digital technology innovation while neglecting its actual impact and market application; Third, some executives with traditional financial backgrounds may prefer conventional financial services and management methods over actively embracing digital transformation, which can slow down the pace of enterprises’ adoption and innovation in new technologies; Fourth, Executives with financial backgrounds may allocate resources more conservatively, favoring mature traditional financial businesses with predictable returns and being more cautious in risk management, thus being risk-averse to digital technology innovation projects with longer return cycle. Therefore, the research hypothesis H3a proposed in this paper is validated.

The moderating effect of financial regulatory intensity between digital financial inclusion and firms’ digital technology innovation is further investigated, with the regression results reported in columns (4)–(6) of Table 7. A positive relationship emerges between digital inclusive finance and financial regulatory intensity through their interaction term (DIF*Supervision), which reaches significance at the 5% level when measuring digital technological innovation in firms. Moderate levels of financial regulation lead to an enhanced positive relationship between digital financial inclusion and firms’ digital technology innovation. Enterprise digital technology innovation experiences a negative significant effect from the quadratic interaction (DIF*Supervision^2) involving digital inclusive finance and financial regulatory intensity. The positive relationship between digital innovation and financial regulations ends at a particular stage of supervisory intensity, leading to reduced enterprise digital technology innovation. Digital financial inclusion functions as a modifying element in digital technology innovation by exhibiting an upside-down U-shaped relationship with regulatory intensity in finance.

The empirical findings match those reported by Ni et al. (2023) and Guo et al. (2025). Financial regulation serves three functions: risk prevention and settlement functions and financial efficiency promotion while enabling digital inclusive finance to boost firm digital technological advancement. Conversely, excessive financial regulation may exacerbate the complexity and volatility of digital financial technology, thereby limiting the enhancement of digital inclusive finance on enterprises’ innovation performance. This implies that while comprehensive financial regulatory coverage is necessary, regulators should also leave enough space for new innovations. Regulatory authorities need to adopt new regulatory tools such as regulatory sandboxes and balance the relationship between financial regulation and financial liberalization. Therefore, the research hypothesis H3b proposed in this paper is validated.

Heterogeneity test

Regional heterogeneity

From the perspective of regional heterogeneity, owing to disparities in resource allocation and market conditions across regions, variations in digital inclusive finance development levels and digital technology innovation capacities inevitably exist among areas. Acknowledging the inherent regional differences, this study examines whether digital inclusive finance exerts a differentiated influence on enterprise digital technology innovation by dichotomizing the overall sample into eastern and mid-western sub-samples, based on the provincial locations of the cities. The regression outcomes are displayed in Table 8. Notably, the correlation coefficients for both eastern and mid-western regions are markedly positive, all achieving significance at the 1% level. Furthermore, the regression coefficients in the mid-western region surpass those in the eastern region, suggesting a more prominent effect of digital inclusive finance on enterprise digital technology innovation in the mid-western region.

These results align with the research conducted by Shang and Liu (2024) and Shi et al. (2025). The primary factor for this alignment is the lesser degree of economic progress in the central and western areas in contrast to the eastern regions. In these eastern regions, communication networks are less established, and market demand-driven impacts are lacking. Within areas experiencing uneven financial development, the channels of transmission and the efficacy of financial policies become more evident. The advancement of digital inclusive finance spurs enterprises to innovate continually to cater to market demands. Moreover, as digital inclusive finance evolves, financial institutions and enterprises in the central and western areas can engage in and establish cooperative agreements via digital platforms. This action not only significantly lowers financing barriers and expenses but also fosters “digital dividends,” offering robust financial backing to enterprises in these regions and augmenting their performance in digital technology innovation.

Property rights heterogeneity

This paper defines state-owned property rights based on the characteristics of the ultimate controller of the enterprise. The regression results for state-owned enterprises are presented in columns (1)–(3) of Table 8. These results indicate that digital inclusive finance has a limited impact on the technological innovation of state-owned enterprises in the digital technology domain. This may be a result of regulatory and policy limits that state-owned enterprises face in terms of innovation in this area, thereby making it more difficult to undertake digital transformation. The regression results for nonstate-owned enterprises are given in columns (4)–(6). These results agree with Lee et al. (2023b) and Lin and Xu (2024). Digital inclusive finance is found to play a more important role in encouraging non-state-owned enterprises to innovate in digital technology than state-owned enterprises; both passed the 1% significance test.

One explanation is that non-state-owned enterprises can quickly react to market changes due to fierce competition. In this way, they can also use resources of digital inclusive finance to innovate technology suitable for the market. Additionally, such enterprises are often more flexible in making decisions and resource allocation, which allows them to respond more rapidly to the availability of the emerging opportunities and challenges of the digital economy.

Conclusions and policy recommendations

Conclusions

Based on the dataset of Chinese A-share listed manufacturing firms spanning 2011–2022, this study empirically examines the impact pathway and mechanism of digital inclusive finance on enterprise digital technology innovation. Key findings include: (i) Digital inclusive finance significantly boosts enterprise digital technology innovation. Enhancing the reach of digital inclusive financial services is crucial for effectively elevating enterprise digital innovation levels. This conclusion remains robust after conducting robustness and endogeneity checks. (ii) Intrinsic mechanism test results indicate that financing constraints and R&D investment partially mediate the relationship between digital inclusive finance and enterprise digital technological innovation. (iii) Moderating effect analysis reveals that senior executives’ financial backgrounds negatively moderate the relationship between digital inclusive finance and enterprise digital technological innovation. Additionally, financial regulatory intensity exhibits an inverted U-shaped moderating effect: moderate regulation amplifies the positive influence of digital inclusive finance on enterprise digital technology innovation, while excessive regulation may hinder innovation beyond a certain threshold. (iv) Heterogeneity test results suggest that the stimulatory effect of digital inclusive finance on enterprise digital technology innovation is more pronounced in mid-western regions and among non-state-owned enterprises.

Theoretical implications

The possible theoretical implications of this paper are: first, this paper innovatively adopts the BERT model to complete the identification of digital patents, which to a certain extent lays a microscopic foundation for the subsequent research; second, it provides an in-depth exploration of the relationship between digital inclusive finance and enterprise digital technology innovation from the aspects of internal conduction path and external influence mechanism, and examined based on both quantitative and qualitative perspectives, in order to enrich the relevant research on the impact of digital inclusive finance on enterprises’ digital technological innovation. Third, the mediating role between digital inclusive finance and enterprise digital technology innovation is explored from the perspectives of financing constraints and R&D investment, and an attempt is made to deconstruct the intrinsic mechanism of the role of digital inclusive finance in enhancing enterprise digital technology innovation. Fourth, the negative and inverted U-shaped moderating effects of executive financial background and financial regulatory intensity in digital inclusive finance on corporate digital technology innovation are further verified.

Practical implications

This study, through empirical analysis, profoundly reveals the pivotal role of digital inclusive finance in accelerating the digital technological innovation process of manufacturing enterprises. Enterprises can leverage the power of digital inclusive finance to effectively broaden financing channels, reduce financing costs, and thereby increase investment in research and development (R&D), enhance the application strength of digital technology, and thus occupy an advantageous position in fierce market competition. This effect is particularly prominent in the central and western regions and among non-state-owned enterprises, providing extremely valuable strategic guidance for policy planners, financial institutions, and enterprise management levels.

Expanding the coverage of digital inclusive financial services is indispensable for improving the digital innovation capabilities of enterprises, further highlighting the necessity for policymakers and financial institutions to expand service boundaries to promote balanced regional economic development and the comprehensive improvement of enterprise innovation potential. Moreover, given that digital inclusive finance has a significantly greater effect on promoting invention patent applications compared to utility model patent applications, this underscores the strategic value of digital inclusive finance in driving in-depth technological innovation and enhancing competitive advantages in the market. It suggests that policymakers and financial institutions need to continuously optimize financial service mechanisms to more accurately support the innovation practices of enterprises.

It is noteworthy that corporate executives with a financial background may, to a certain extent, impede the positive relationship between digital inclusive finance and corporate digital technological innovation. This impediment may arise due to the tendency of financially-oriented executives to prioritize short-term financial performance and the security of traditional financial instruments, consequently constraining the effective integration of digital inclusive financial resources and innovation investments within enterprises. Hence, in constructing the executive team, enterprises should holistically consider the diversity of members’ backgrounds, seeking an equilibrium between financial stability and innovative development. Additionally, policymakers and financial institutions must scrutinize this phenomenon and introduce professional training and incentive programs to augment executives’ comprehension and emphasis on digital inclusive finance and innovation strategies, thereby aiding enterprises in leveraging digital inclusive financial resources to expedite technological innovation.

Limitations

The limitations of this study are acknowledged to affect the comprehensive understanding of the findings. However, the research in this area is not complete despite the exploration of the internal link between digital inclusive finance and corporate digital technological innovation. Beyond digital inclusive finance as a core element, corporate technological innovation can also be determined, to a large extent, by potential mechanisms, including corporate social responsibility and institutional investor preferences. More investigation of these mechanisms is warranted further in depth.

Moreover, the time and relevance of research findings, as a result of the rapid advancement of digital technology, is an enormous challenge to sustain. Our research methodology has to be constantly updated to the constantly changing world of digital technology in order for our content to continue to be relevant to the progress of the technology. This ensures the relevance and practical utility of our results since new technologies continue to emerge as corporations embrace them.

However, when applying the research findings to practice, their limitations need to be acutely aware. As Chinese A-share-listed manufacturing companies are multi-dimensional, this study mainly concentrates on Chinese A-share-listed manufacturing companies, and the results can not be generalized to other enterprise types or industries. The practical effects of digital inclusive finance are complex and impacted by many factors, including regional cultural differences, corporate internal organizational structures and cultures, and policy environment uncertainties. Nevertheless, these factors have not been properly investigated or quantitatively analyzed in this study.

Additionally, measuring the digital inclusive finance and innovation outcomes with accuracy is a difficult thing to do. While this study uses patent data as a proxy coverage for innovation, all of the proxy does not cover the full depth or breadth of internal innovations within companies. Similarly, the measurement of digital inclusive finance is as complex and variable due to various interpretations and calculation methods that partially restrict the depth of discussion in this study. Lastly, the generality of the findings is limited, primarily concentrating on non-state-owned enterprises in China. The selection of this specific sample may render the research results not entirely applicable in other business types or economic contexts.

Future research directions

Despite our thorough examination of the inherent link between digital inclusive finance and corporate digital technological innovation, research in this domain remains far from exhaustive. Beyond digital inclusive finance as a key component, other potential mechanisms such as corporate social responsibility and institutional investor preferences may also significantly influence corporate digital technological innovation. These influence mechanisms necessitate further detailed exploration. Additionally, current research largely relies on resource-based theory and information processing theory, which inadequately explain how digital inclusive finance interacts with internal corporate resources to foster innovation jointly. Future research can expand the scope of its theoretical concept by integrating institutional theory, network theory, and other frameworks to more comprehensively unveil the intricate relationship between digital inclusive finance and corporate innovation. Besides, the specific mechanisms of digital inclusive finance in different industries and firm sizes have not been sufficiently explored by existing research. It is expected that future work will further analyze such differences to gain more theoretically oriented insights into the matter.

Future research should seek methodological concerns as a means to improve the accuracy and reliability of research results. Existing studies rely on cross-sectional and panel data analysis, in the future, longitudinal studies should be conducted to understand the long-term effects of digital inclusive finance on corporate digital technology innovation. For the most part, research is based on quantitative analysis, while qualitative research methods, such as in-depth case studies and interviews, may be adopted in future studies to further study the basis of the relationship between digital inclusive finance and corporate digital technology innovation. Currently, there are still limitations in the measurements of variables that exist in the ongoing research; therefore, future studies can be enhanced by presenting a broader range of digital inclusive finance and innovation indicators such that the situation of the research subject can be more truly presented. Existing studies in dealing with endogeneity issues mainly rely on the use of lagged variables and instrumental variables, among other techniques. Endogeneity can be tricky, where past data cannot be corrected or forecast to eliminate the effects controlling for all other relevant factors, and the future study can consider using complex econometric techniques, such as Propensity Score Matching and Regression Discontinuity analyses, to address this more effectively.

Future studies should also conduct cross-cultural research to verify the general applicability of the research’s results. Most previous studies have been conducted on Chinese A-share manufacturing companies. The relationship between digital inclusive finance and corporate digital technology innovation could be expanded to other regions and industries to determine its applicability to other financial and innovation environments. Future research can be a cross-country comparative analysis of the impact of the level of development of digital inclusive finance, policy environment, and cultural environment on enterprise digital innovation in different countries. Furthermore, in the future research, other cross-cultural case studies can be carried out to investigate how enterprises are using digital inclusive finance to innovate in various cultural contexts.

Policy recommendations

For policymakers, it is significant to expand the coverage and breadth of digital inclusive financial services for enhancing enterprises’ digital innovation capabilities. Specifically in emerging markets with underdeveloped infrastructure, uneven financial resource allocation, and limited corporate innovation capabilities. It is imperative for policymakers to broaden service coverage, particularly in mid-western regions and non-state-owned enterprises, to foster the balanced regional economic development and comprehensively enhance the corporate innovation potential. Furthermore, to balance financial innovation with risk prevention, it is crucial to optimize the framework for financial regulation. Especially in emerging markets, financial regulation faces greater uncertainty and risks, so the accuracy and efficacy of regulatory policies are particularly important. To develop such a precise, prompt, and insightful regulatory technology system, according to big data and AI technologies, policymakers need to create real-time monitoring and focused supervision of digital inclusive finance. Besides, differentiated regulatory measures should be implemented based on regional, industrial, and enterprise characteristics to enhance regulation’s focus and impact. Furthermore, relevant departments should encourage financial institutions to develop tailored financial products and services for enterprise digital technology innovation and introduce financial incentive measures like tax breaks and R&D subsidies to alleviate financial burdens on tech and scientific innovation enterprises.

For financial institutions, traditional ones should actively integrate digital technology to enhance service efficiency and coverage, achieving broader accessibility and promoting financial service popularization. Lowering transaction costs and other marginal expenses can better meet enterprises’ financing needs. Relevant departments must mitigate information asymmetry by thoroughly understanding business conditions and needs, offering more customized financial services. Financial institutions should also grasp the business traits and financing needs of various enterprises, fostering relational lending to build long-term, close partnerships with them.

For enterprise managers, enhancing investment and utilization of digital technology is crucial, especially for state-owned enterprises, as they explore new business models and market potentials to bolster competitive strength. Enterprises should actively engage with the financial market, leveraging digital inclusive financial services to fund technological innovation while effectively mitigating financing risks. Equally important is fostering an understanding of digital inclusive finance among corporate executives. On one hand, when assembling the executive team, corporate managers should incorporate executives from diverse backgrounds—finance, technology, management, and innovation—to ensure team diversity while balancing financial stability with innovative growth. On the other hand, companies should enhance executives’ comprehension and emphasis on digital inclusive finance and innovation strategies through targeted training and incentives, aiding enterprises in fully harnessing digital inclusive financial resources to accelerate technological innovation.

Responses