The role of insurers in driving post-hurricane risk reduction investments

Introduction

The National Oceanic and Atmospheric Administration finds that between 1980 and 2023, hurricanes caused the most damage of all natural disasters in the U.S., at over $1.3 trillion, and had the highest average costs per event. These storms can be extreme negative financial shocks for households1. Insurance can provide financial protection, yet the growing risk of these storms is stressing insurance markets, with prices rising and availability declining in high-risk areas.

Studies suggest that climate change will intensify hurricanes2,3, increase the frequency of “stalling” the forward movement of storms4, and slow down their dispersion after landfall5. Recent research also indicates that the likelihood of two storms occurring in quick succession has increased and is projected to rise further as warming continues6. All of these trends will lead to greater levels of damage if no action is taken to reduce exposure.

Bending down the loss curve from these disasters—to stabilize insurance markets and protect households financially—can be achieved in many ways, including but not limited to changing the way we build and the locations where we cite development. Research has found that many mitigation measures are cost-effective and can save money by reducing disaster damages over the life of a structure7,8,9. Incorporating such changes at the time of rebuilding is an important opportunity. Once capital is destroyed, the additional costs of building to safer standards are typically smaller than retrofitting existing structures. Existing literature on the determinants of mitigation investments has primarily examined the role of individual risk perceptions10, behavioral factors11,12, and neighborhood spillovers13. Some studies focus on the relationship between individual insurance purchase decisions and risk reduction activities, providing mixed evidence on whether they act as substitutes or complements14. Using data from a survey of hurricane survivors, our paper identifies the unique role of insurers in driving greater investments in risk reduction post-hurricane, more deeply examining the link between insurance and mitigation15.

To examine the factors that influence household decisions to adopt mitigation measures during rebuilding, we draw on a unique survey of households that experienced damage from one of four U.S. landfalling hurricanes between 2017 and 2021. The survey was designed to elicit information on households’ financial recovery, identifying the damages they sustained, the sources of economic support they used for recovery, and any remaining unmet needs. The survey also asked questions about post-storm investments in risk reduction. Households were sampled using an online survey tool, Qualtrics, with samples designed to match the socio-economic characteristics of the community impacted by the storm. Compared to other convenience sampling via Facebook or MTurk, Qualtrics has been found to generate more representative samples16. Still, one may be concerned that households without easy access to internet or that were more severely impacted by the disaster long-term could be under-represented in online surveys. These biases, however, would tend to attenuate our results. The survey was peer-reviewed and contained accuracy screeners and attention checks. More details on the methods of this survey can be found in You and Kousky1. For this analysis, we limit our sample to 325 homeowners who experienced either damage to their home or contents from the hurricane. These households were roughly equally spread across the four hurricanes in the sample: Hurricane Harvey in 2017, Hurricanes Florence and Michael in 2018, and Hurricane Ida in 2021.

The survey asked households, when repairing their property, if they undertook any specific mitigation actions. We find that 31% (100 out of 325) did not adopt any such measures. Among those that did invest in mitigation upgrades, the most common activities were upgrading the roof (69%) or upgrading or replacing windows and doors (44%). A smaller percentage of respondents elevated their HVAC (26%), elevated their home (25%), installed flood vents (24%), or used flood-resistant materials in rebuilding (23%). Overall, more than 63% undertook more than one action, with the median households investing in two activities. Notably, of those who retrofitted, the majority were insured at the time of disaster: 88% reported having either homeowners or flood insurance. This motivates further exploration into the role that insurers play in incentivizing mitigation decisions.

Hurricanes cause both wind and water damage and the above-mentioned mitigation actions can help reduce both types of damage. Home elevation and using flood-resistant materials reduce the likelihood of floodwaters entering a home, while raising HVAC and installing flood vents lowers the severity of flood damages after floodwaters have already entered the home. Upgrading the roof or doors and windows, on the other hand, helps prevent damage to the building from high winds. The specific payback period for any mitigation will depend on the type of measure, the specific risk, property details, as well as any discounts provided by the insurer. Nonetheless, in general, these measures have been found to create savings from mandated building codes8,17, particularly in high-risk areas18. Despite these savings, research has identified that underinvestment occurs due to misunderstandings or lack of awareness of risk, behavioral biases, or financing constraints19,20.

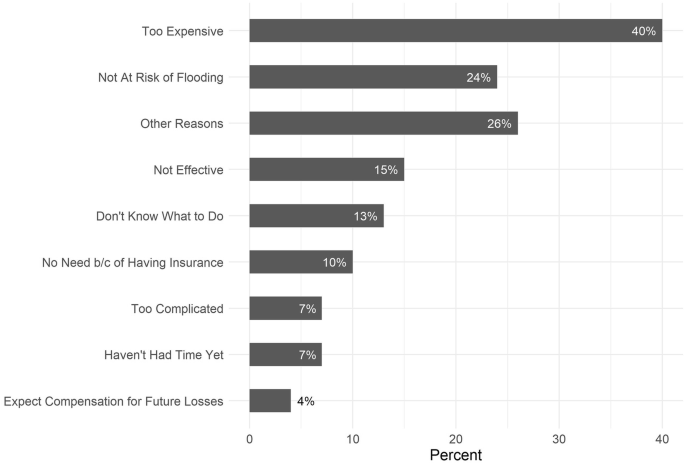

When the 100 respondents who did not invest in mitigation post-storm were asked why not, as seen in Fig. 1, 40% responded that it was “too expensive” and 24% thought they were “not at risk of flooding.” Another 13% responded that they did not know what to do. This suggests that the availability of funding and information are two key determinants of making mitigation upgrades post-disaster.

In the survey, we asked the 100 respondents who did not invest in mitigation about the reasons why they did not do so. The figure presents summary statistics for their responses.

We explore this further in a regression framework to control for other possible factors with a focus on understanding the influence of funding and information. We run the following specification:

where Yi represents risk mitigation decisions made by individual i during rebuilding. Our outcomes of interest include whether or not a household invested in any form of mitigation, and, if so, the specific types of actions. Costi represents disaster-related financial costs, Householdi represents a vector of household characteristics (including having property/flood insurance, having savings, income, race, employment status, number of residents, and whether there are family members in need of care), and Homei represents a vector of home characteristics (including home tenure, home mortgage status, and home type). To identify the role of information, we include a binary variable, Informationi, which captures the respondent’s answer to a survey question asking if at any point in the recovery process they received information on actions that could be taken to lower the risk of future damage. Eventi are fixed effects for each hurricane. Standard errors are clustered by hurricane and estimated with bias-reduced linearization adjustment to account for a small number of clusters.

Results are shown in Table 1. We find that property owners who were informed about mitigation actions are roughly 2.9 times (e1.357-1) more likely to engage in risk reduction actions (Column 1). This includes installing flood vents (Column 2), elevating HVAC systems (Column 3), and upgrading the roof (Column 4). We also find that if a household was insured at the time of the storm, indicating a greater likelihood of dollars available for repairs and rebuilding, they are 124% (e0.808 – 1) more likely to invest in risk reduction. Compared to the uninsured, they are more likely to upgrade their HVAC system (Column 3), improve their roof (Column 4), and use flood-resistant materials for home repair (Column 8). We find that those with savings are more likely to upgrade their door or use flood resistant materials but not to invest in more expensive measures. This could be because the majority of Americans have only very small levels of savings. According to the Survey of Household Economics and Decision-making (SHED) conducted by the Federal Reserve Board (2022), approximately half of the U.S. households could only cover an expense up to $2,000 using their current savings.

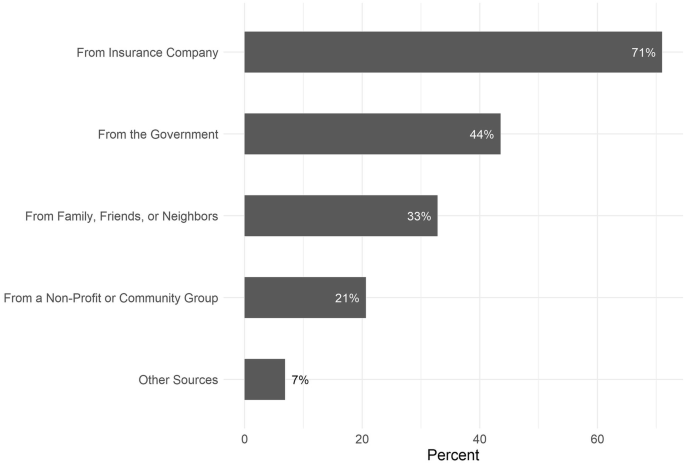

Another survey question asked where respondents received information about risk reduction activities. Figure 2 shows that the majority of households reported receiving information from their insurance companies, followed by the government and then their social network.

In the survey, we asked the 131 respondents who reported receiving information about risk reduction activities where they received such information. The figure presents summary statistics for their responses.

Finally, the survey asked about the role of financial incentives. Respondents were asked to what extent receiving a discount on insurance would motivate them to undertake risk reduction actions. Responses, unsurprisingly, varied among those insured or not at the time of the storm. In both groups, roughly a third of respondents indicated that it would motivate them “very much,” but among the uninsured, 30% said it would not motivate them at all, while only 6% said “not at all” among the insured. This is unsurprising since premium discounts only provided benefits to those with a policy.

We conduct two robustness tests to validate our findings. First, we split the sample into the three pre-COVID hurricanes and the one post-COVID hurricane. Our results remain quantitatively similar. In addition, another survey question asked if households lost income from the storm. Our results are again similar across the 43% of respondents who do report a loss of income and the 57% who do not.

Our survey findings highlight the important roles of both information and available funding to drive mitigation investments and shed new light on the critical role that insurance companies play in this process. Insurers are both a provider of information about risk reduction to their clients and also provide financial incentives or direct funding to support such investments. These findings echo insights from Mulder and Kousky (2023)21 and Boomhower et al. (2023)22 that insurers have this dual role. These results may also partially explain prior research findings that those that are insured are more likely to have invested in mitigation14,23. While extreme risk aversion has been invoked to explain such findings, the role of the insurer could be another mechanism, particularly in the rebuilding process when mitigation efforts can be more easily integrated.

As escalating losses continue to stress insurance markets and impose financial hardship, expanding investments in hazard mitigation has become a key objective for governments and communities. Our findings indicate insurers have a role to play in achieving this objective. Insurance regulators have long mandated insurer involvement, such as through required discounts on hurricane-safe building in Gulf Coast states. The state of California has recently adopted similar mandates on premium reductions for safer building exposed to wildfires.

Insurers, though, could go further and also provide funding for these investments through endorsements, which are additions to standard property policies that would provide households extra funds during rebuilding to invest in mitigation. For example, in some places along the Gulf Coast, insurers have offered “Fortified endorsements” to cover the costs of rebuilding to Fortified standards. Developed by the Institute for Building and Home Safety, the Fortified building standard can improve a home’s capability of withstanding severe winds and significantly lower damage caused by hurricanes24. Our survey results suggest such endorsements, tied to information and outreach to education households about the investments, could drive resiliency upgrades during rebuilding, thus lowering the costs of future storms. The National Flood Insurance Program, the primary provider of flood insurance, has a small program to do this currently, but it could be expanded to cover more expensive upgrades, such as elevation25.

Responses